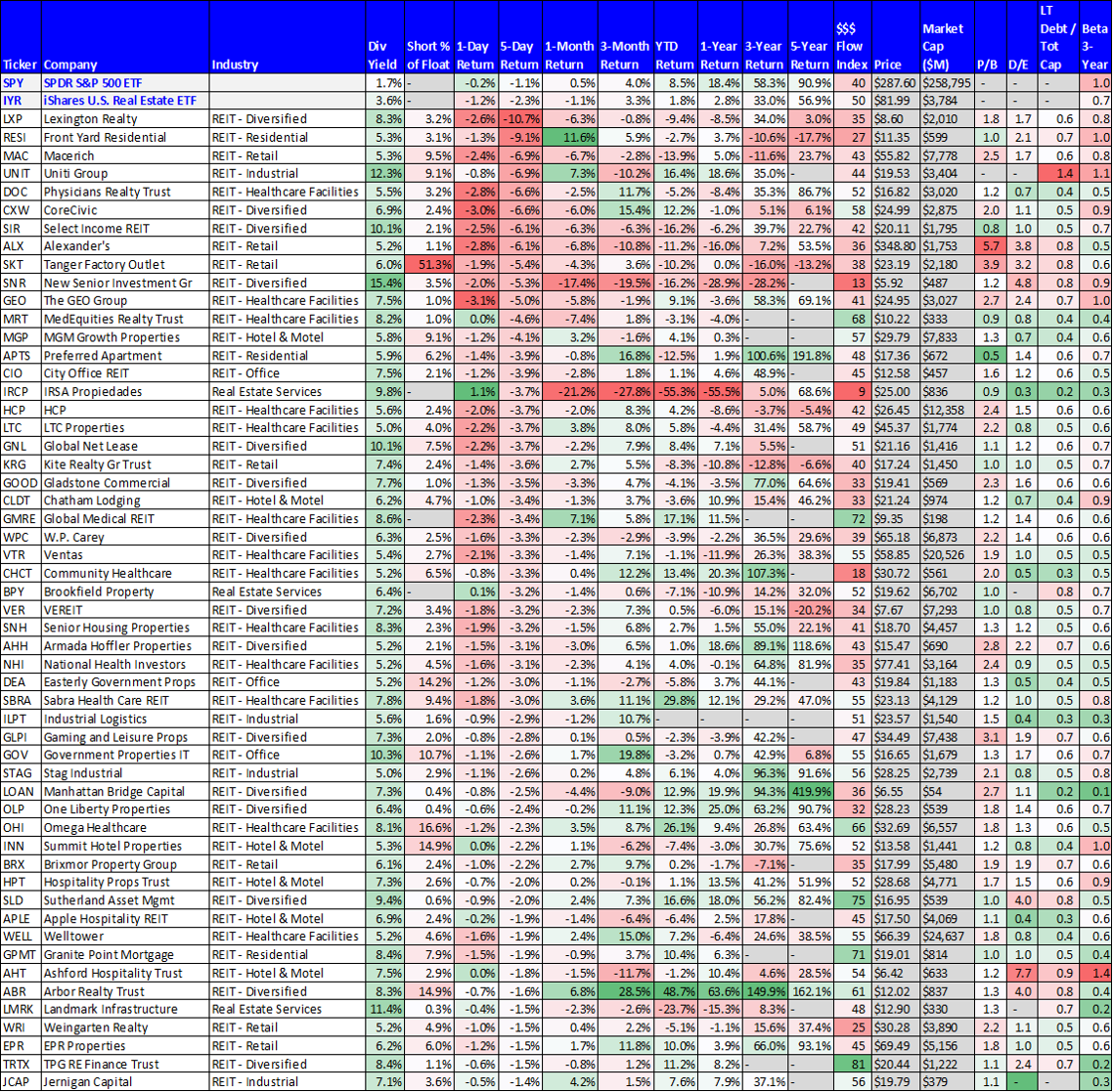

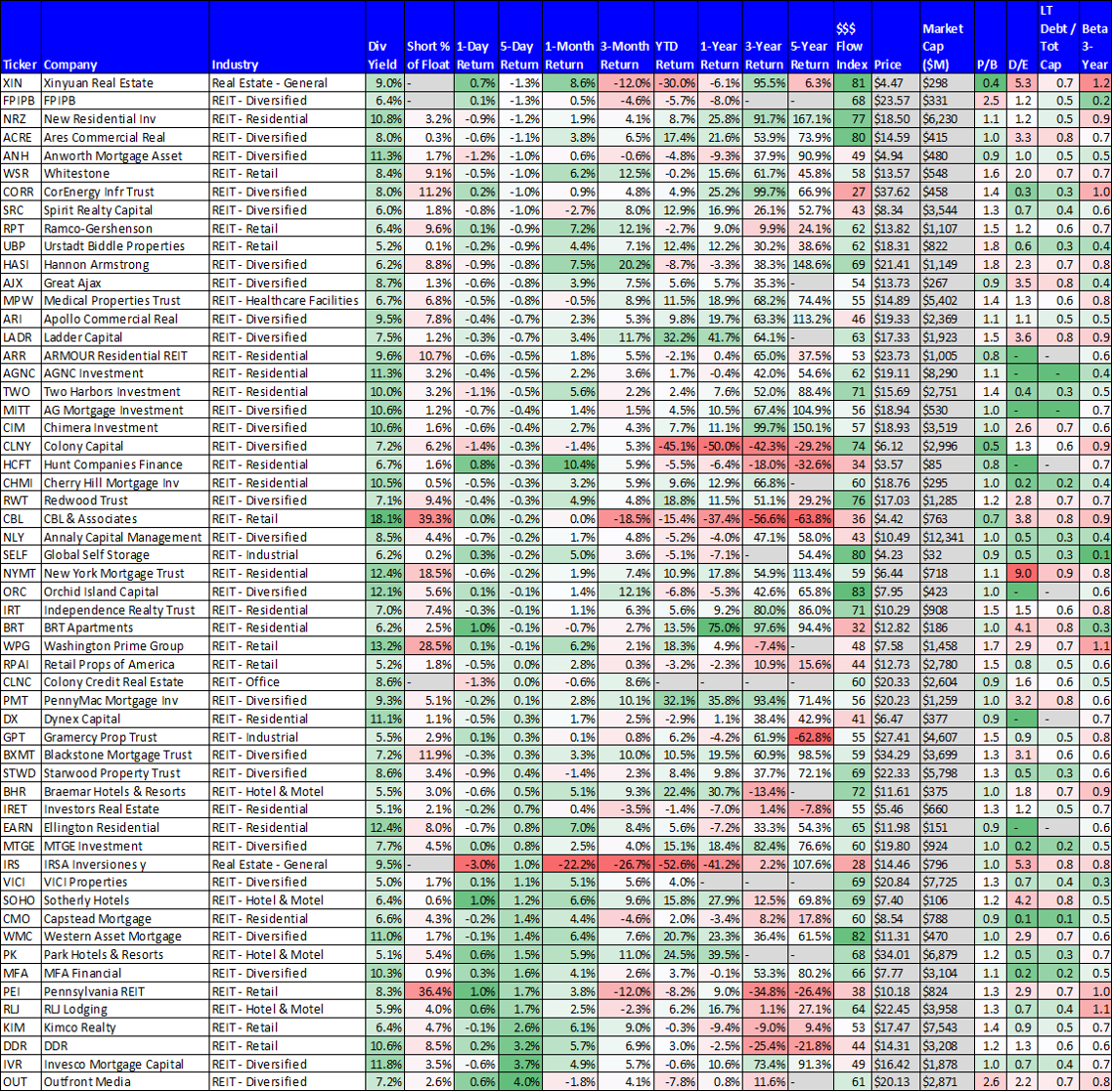

After sharing data on over 50 high-yield REITs (defined as REITs yielding at least 5%) that sold-off last week, we provide details on one that is increasingly attractive and worth considering.

Here is the full table on over 100 high-yield REITS (over 50 sold-off last week, again).

In fact, REITs have underperformed the market significantly in recent years, and in some cases, babies are being mistakenly thrown out with the bathwater. For example, Macerich (MAC).

Macerich (MAC), Yield: 5.3%

Macerich is a shopping center REIT, but before you sigh in exasperation of the Internet’s ongoing damage to brick and mortar stores (people are increasingly shopping online), Macerich is different. Macerich owns A-class mall REITs, in attractive, highly trafficked and convenient locations. The type of locations that aren’t put out of business by the Internet (online sales). And for these reasons, Macerich is able to charge higher rent per square foot, maintain higher occupancy, and generate much higher sales per square foot that its B-class competitors that have a much harder road ahead.

And what makes Macerich particularly attractive to us is that the market is misunderstanding this business. Not only is the market incorrectly lumping Macerich in with all retail shopping REITs, but it is also misunderstanding the smart steps Macerich is taking to strengthen the business and avoid the carnage that other retail REITs are experiencing.

For example, the company continues it strategy of selling non-core assets and recycling the capital into higher quality assets. This makes it appear that Macerich is in distress, selling off assets and not growing its funds from operations. In reality, Macerich is strategically keeping its assets high quality, while other REITs (largely B-class) will continue to slowly bleed over the long-term. For example, Macerich recently sold two power centers -Casa Grande Center (May 17, 2018) and The Market at Estrella Falls (July 6, 2018). Both assets are in the suburban Phoenix market. The company's share of the net proceeds totaled $35 million.

Next, investors are misinterpreting Macerich’s recently lowered forward guidance, and this is a big part of the reason the shares sold-off. However, management lowed guidance for a good reason. For example, MAC’s guidance for lease termination revenue is being reduced from $22 million to $15 million for 2018. That is a short-term phenomenon, and it’s a good thing because it means business is healthier than the company previously forecast (we like management that provides conservative estimates). For example, here is what management had to say in Macerich’s last earnings release:

"During the quarter our portfolio continued to perform well. We achieved good re-leasing spreads strong tenant sales growth and quarter over quarter occupancy gains," said the Company's chief executive officer, Arthur Coppola. "The leasing environment continues to improve including a significant number of deals with legacy retailers as well as with digitally native retailers. We continue to be encouraged by digitally native retailers' growing demand for great real estate locations."

Valuation:

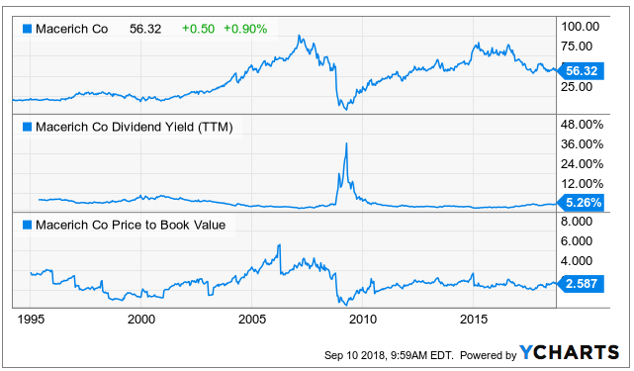

From a valuation standpoint, here is a look at Macerich’s price, versus dividend, versus price-to-book-value in recent years.

We like that the dividend yield is a little higher now that it has been in recent years (excluding the short-term market wide sell-off during the financial crisis in 2008-2009) because we view that as a signal from management. Specifically, management often sets the dividend at a level based on where they believe the share price should be, and in this case the lower share price and higher than normal dividend is a good signal from management. Also, from a price-to-book standpoint, Macerich remains reasonably valued.

For example, here is a look at the company’s historical valuation metrics, which are currently low compared to averages.

And we view this as a good sign because Macerich continues to have plenty of FFO per share to support its price.

Next, here is a look at some forward-looking funds from operations (“FFO”) data (based on Wall Street analyst estimates) that further supports the notion that the company will continue to have a strong business.

And for reference, these same analysts (all 18 of them) believe, on average, that the shares are underpriced, as shown in the following analyst price target chart.

The Bottom Line:

Macerich remains a healthy A-class REIT that is trading at an attractive price. The dividend yield is attractive and well-supported by the business, thanks to management’s smart strategy and focus on high-quality properties that can co-exist with the internet and online sales. And also thanks to management’s pro-active approach to position the portfolio correctly (even though the market is misunderstanding management’s moves in the short-term—that’s why the sell-off). If you are an income-focused investor, Macerich is worth considering because of its 5.3% yield and its potential for continued price appreciation in the years ahead.