At Blue Harbinger, we write a lot about individual stocks, but many investors seek more balance between stocks and bonds. High income and lower volatility can be attractive qualities of a balanced portfolio. This report shares our thoughts, and a few specific ideas, on a balanced portfolio, including stocks and bonds.

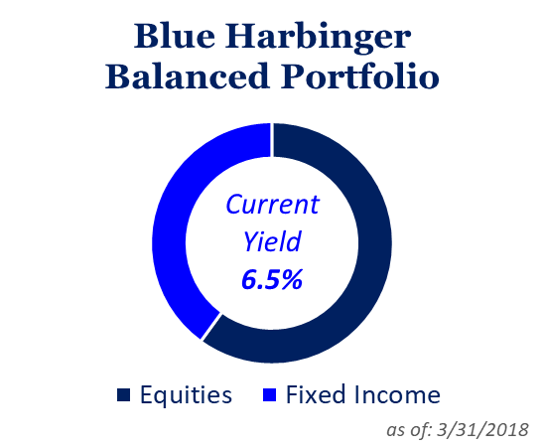

Per reader demand, we are launching a new 60/40 balanced portfolio. 60% stocks and 40% bonds, as shown in the following table...

As mentioned, the holdings in the above portfolio add up to 60% equity, 40% fixed income (we're counting preferred stocks as fixed income), and the yield on this portfolio, in aggregate, is an attractive 6.5%.

The holdings are as of 3/31/2018, and here are a few brief notes on each of the holdings in the portfolio...

Adams Diversified Equity Fund (ADX): We own this closed-end fund in other Blue Harbinger portfolios. It has been paying a dividend since 1929, and the yield was 9.8% in 2017 (the fund targets a minimum annual yield of at least 6%, but pays higher depending on market conditions. We like the high-yield, the conservative management, the discount to NAV (currently -14.7%), and the recent price pullback.

We wrote in more detail about ADX a couple months ago in this report and in these reports.

meriGas Partners (APU): This propane distributor sold off recently despite the relatively colder winter which will help business. The distribution 9.4% yield is juicy, steady and attractive, but investors should be congnizant of the MLP tax status.

BlackRock (BTZ): This closed-end fund is attractive for a variety of reasons, including its 6.4% distribution yield (paid monthly), its discounted price relative to its NAV, its relatively low management fee (0.81%), its conservative use of leverage (22.4%), its access to low institutional borrowing rates, and the fact that as a closed-end fund it's not subject to the forced issuance and redemption of shares that cause bond ETFs to be so inefficient due to trading costs and being forced to sell and buy at inopportune times.

Regarding the current discount to NAV (-11.6%) this basically gives investors access to the high yields of the underlying securities within this fund, at discounted prices. The fund holds around 48% investment grade bonds, 26% high-yield bonds, 14% non-US developed market bonds, and the remainder a mix of securitized products, US government related and emerging market bonds. More information is available on the BlackRock website here. We also wrote about this CEF here.

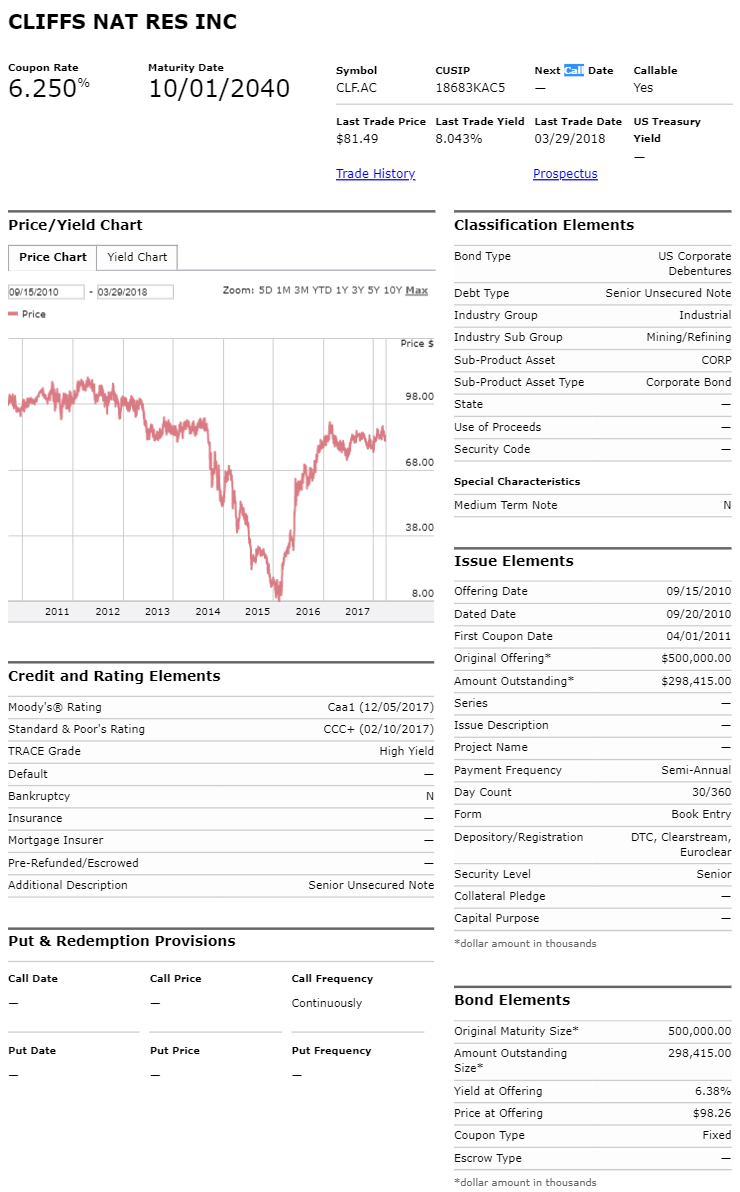

Cleveland Cliffs (CLF)) 2040 Bonds: We purchased these bonds not only for the attractive high yield, but also for the expected price appreciation. After weathering the challenges of 2015, Cliffs continues to be hampered by lower iron ore prices. However, it has plenty of financial wherewithal, and we expect continued debt reduction from Cliff's free cash flow generation--which will be good for the price of these bonds.

Digital Realty Trust (DLR): Digital Realty is an attractive data center REIT benefiting from the ongoing corporate shift to the cloud. However, there is a lot of fear mongering surrounding Digital Realty. Nonetheless, we believe its 3.4% dividend is safe and it will grow, and its price will increase too. This article reviews four fears circling Digital Realty, and then highlights three reasons why we currently like it.

Emerson Electric (EMR): Emerson has a reputation for automating industrial processes, and its newly streamlined portfolio continues to go strong, particularly in emerging markets. Emerson has a long history of returning healthy free cash flows to investors via growing dividends and share buybacks. Like the rest of the market, the shares have pulled back in recent weeks, thereby making for an attractive buying opportunity, especially considering the economy remains strong.

Ferrellgas (FGP) 2020 Bonds 8.625%: We believe the bonds of this propane distributor have the cash flow to support their debts (especially after this relatively cold winter), and these bonds are relatively safe and attractive. These are the first of multiple years of maturities (as shown in the following table) thereby adding to safety, in our view.

The equity is suffering as the distribution was cut over a year ago, and as financials continue to be tight. The bonds are ahead of the equity in the capital structure, and these bonds are attractive.

Johnson & Johnson (JNJ): Johnson & Johnson is an attractive, diversified, blue chip health care company, and the recent share price pull back makes for a more attractive entry point, in our view. If you're looking for strong, steady, lower beta exposure to growth and income, JNJ is worth considering. We've owned this stock in our other Blue Harbinger portfolio for a while, and you can read those JNJ updates here.

Main Street Capital (MAIN): This attractive internally managed Business Development Company (BDC) has multiple things going for it, including a healthy yield (6.2%), a quality book of investment business (they provide financing to help lower middle market companies), and an attractive valuation (especially after the recent sell off). Plus, the new tax law (that President Trump signed two weeks ago) allows BDCs to essentially double the amount of leverage they are using, which will help Main Street going forward. We've written about Main Street Multiple times in the past. For example, here.

New Residential Investment Corp (NRZ): Management continues to evolve with the evolving residential mortgage industry, and this is what allows the company to keep growing and keep paying big dividends. This company announced strong earnings in February, and we've written about it in the past (for example, here and here).

NuStar Fixed/Float Preferreds (NS-C): These preferred shares are attractive for a variety of reasons, including the discounted price and the high yield (+9.7%). Plus, the yield has a fixed-to-floating clause which helps protect investors from some of the interest rate risk. We wrote about NuStar in detail two weeks ago in this article.

Phillips 66 (PSX): Our thesis remains the same here. Phillips 66 is being valued like a refiner, but it should increasingly be valued like a midstream, which gives it multiple expansion potential, in our view. It has sold off this year, which makes it an even more attractive opportunity. We've owned PSX in other Blue Harbinger portfolios, and you can read more here.

Pimco Dynamic Credit and Mortgage Income Fund (PCI): We own this one for the income, the diversification, the discount to NAV, and the strong management team. You can read our write-up for this closed-end fund ("CEF") here.

Procter & Gamble (PG): If you're looking for steady yield with low-beta price appreciation potential, Procter and Gamble is hard not to consider. It's trusted products (e.g. toilet paper, laundry detergent, etc.) aren't going away. We also own this one in our Income Equity portfolio, and you can read our previous write-ups here.

Royce Value Trust (RVT): This is an attractive closed-end fund ("CEF"). Not only does it trade at a discount to its net asset value, but we especially like the small cap exposure. Small caps have been lagging large cap stocks even though they historically outperform, and we expect small cap in general (and this fund, in particular) to perform well going forward. Income investors often do NOT invest in small caps because they usually don't offer high yields, but this is a great way to get the attractive exposure and a large high-yield distribution yield.

Royce Micro Capital Trust (RMT): This microcap stock closed-end fund is a compliment to RVT (above). It provides attractive efficient expose to micro-cap stocks, and it enjoys a discounted price, a strong management team, and big steady distribution payments for investors.

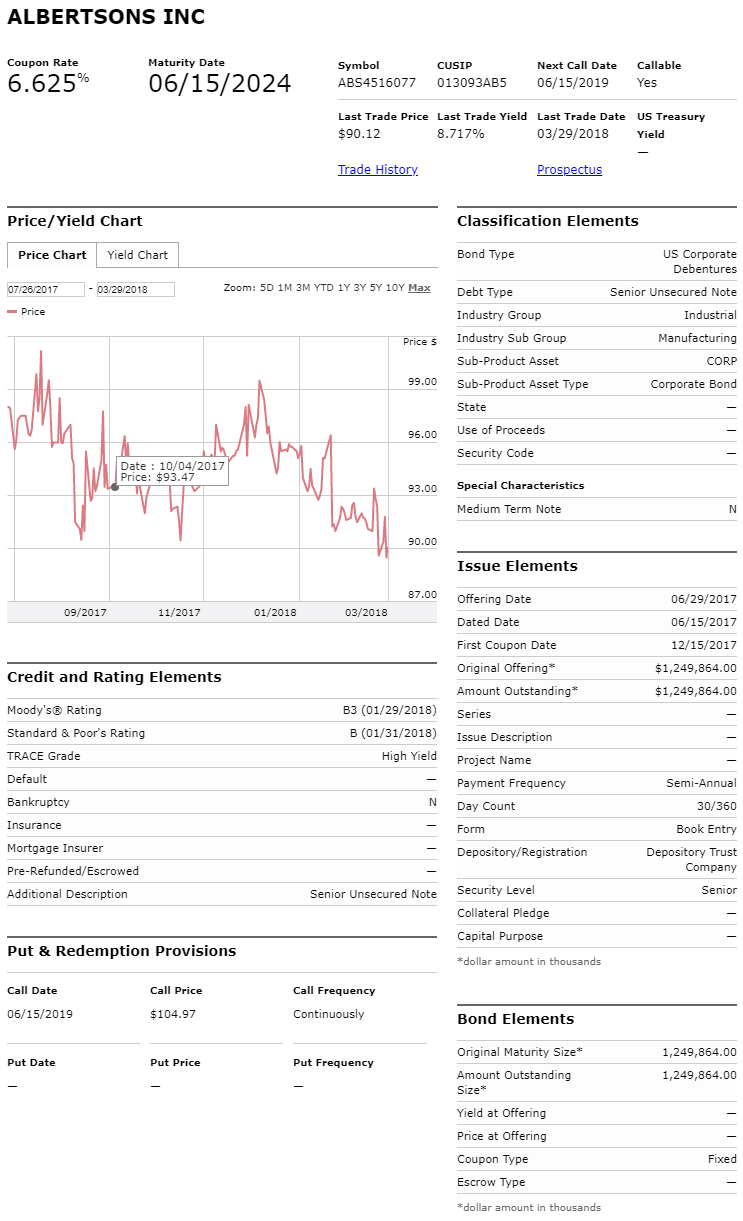

Albertsons/Safeway 2024 Bonds: Safeway went private in 2015 after being acquired by Albertsons, but the bonds still trade publicly, and they offer an attractive yield with upside price potential. The bonds have sold-off lately as Albertsons' planned acquisition of RiteAid is making some investors nervous, particularly regarding antitrust. In our view, the discounted price on these bonds makes them attractive either way considering a cancellation of the deal would likely cause a relief rally, and a completion of the deal would actually benefit Albertsons as described in this recent investor presentation. Significant yield and price appreciation potential make these bonds attractive.

Seagate (STX) 2027 Bonds: Despite the move away from hard drives in favor of the cloud, Seagate is a healthy business, and even if the equity struggles, these bonds are relatively vet safe. They also trade at a discount and offer an attractive yield (currently over 5%).

ServiceNow (NOW): This is a growth stock with significant upside price appreciation potential. It does NOT pay a dividend. It has has high margins, it has been growing rapidly, and it is forecasting continued rapid growth. Further, it has no real direct competition at this point. You can read our recent write-ups here and here.

Skyworks Solutions (SWKS): This semiconductor chipmaker is inexpensive in our view, and it deserves a higher multiple. And more importantly, it has continued powerful growth ahead as smart device use continues to increase, and as the complexity of smart device chips continue to increase. Skyworks is on of the high margin semiconductor companies because it is more sophisticated and cutting edge, and it wins chip business that others simple cannot. Plus it's still small enough that it has more room to grow. We've written about Skyworks in more detail multiple times in the past in these articles.

Square (SQ): To the chagrin of value investors everywhere, this 2-year old stock has negative net income. However, what it does have is an extremely high growth rate (see revenue growth chart below), a large total addressable market (estimated at $60 billion, current annual revenues are just over $2 billion) and the shares are priced more attractively considering our recent market wide sell-off has pulled the share price lower. You can read our full write-up on this power payment processing company here: A Stock With Big Upside, Especially After the Recent Market Wide Sell-Off.

Teekay Offshore Partners Preferreds (TOO-B): High income, a discounted price, and an improving business. What's not to like. You can read our full write-up here.

Teekay LNG Fixed-to-Floating Preferred (TGP-B): If you like TOO-B (above), you might also want to consider the preferred shares of sister entity Teekay LNG. They have many of the same attractive qualities, plus a fixed-to-floating rate requirement that helps reduce potential interest rate risks. You can read our full write-up on this one here.

Transocean Bonds 2023 Bonds (RIG): Despite the harsh turn down in the offshore rig market, Transocean has been wisely optimizing its fleet by scrapping old rigs--which will be good for long-term supply and demand. Plus, the company's backlog of business easily runs beyond 2020, which will provide near-term financial support. In addition to the high-yield--we expect some price appreciation on these bonds too.

We expect to benefit from attractive price appreciation on these bonds long before they mature in 2038. And in the meantime, we're happy to collect the out-sized coupon payments, which we just purchased at an attractive discount.

Triangle Capital Corporation (TCAP): This high-yield BDC took a hit when it announced a distribution reduction with essentially zero warning. Investors were not pleased, and the shares sold off dramatically. However, the new BDC laws that were included as part of the recent budget President Trump signed a couple weeks ago will benefit BDCs including TCAP. Specifically, BDCs are now allowed to essentially double their leverage ratios from 1x to 2x. The new rules will especially help TCAP as the cap rates on new investments are not as high as they were shortly after the financial crisis. TCAP's new investments are less risky than the old, but also less risky. And the new leverage limits will help the company maintain an attractive yield for investors.

Emerging Market ETF (VWO): This emerging market equity ETF provides efficient, low-cost exposure to the power of emerging markets. This is an important investment allocation that we don't want to miss out on, and this is an attractive way to play it.

W.P. Carey Inc. REIT: The shares of this high-income blue chip industrial REIT have sold-off as the overall REIT sector has sold-off, thereby creating an attractive opportunity to pick up high yield at a lower price. The REIT sell-off is significantly overblown (interest rates are normalizing), and this is an attractive buying opportunity. Read more about WPC here. Note, these are total returns (dividends plus price appreciation) in the following chart.

Bottom Line:

A balance between stocks and bonds can reduce volatility, reduce risks, and keep income payments high. We believe the mix of stocks and bonds in the portfolio described in this article is attractive. We created this portfolio in response to multiple reader requests. We plan to provide updates as well as track performance of this Blue Harbinger Balanced Portfolio going forward. Stay tuned.