These preferred shares are trading at a discounted price and they offer an attractive 9% qualified dividend. We believe the business is getting much stronger, and now is an attractive time to buy.

Specifically, we like Teekay Offshore, 8.5% Series B Preferred Stock (TOO-B). These shares offer a coupon payment of 8.5% and they currently offer a 9% yield because they are trading at a discounted price of $23.60. The shares are redeemable by Teekay starting on 4/20/2020 at $25 per share (see all the details here). This means investors can lock in a roughly 11.5% total return in each of the next two years if Teekay redeems the shares (which seems increasingly likely given the high yield, and Teekay’s improved and improving financial position, combined with the fact that the company is likely about to redeem and replace the high yielding Series A shares (TOO-A) (which become redeemable on 4/30/2018) using the proceeds they just raised by issuing the new (arguably less desirable) floating rate Series E preferred shares (TOO-E)).

We’ve written about Teekay (TOO) (and these preferred shares) in the past (for example: here and here), but the company is basically an international provider of marine services (shipping) and solutions to the offshore industry, concentrating on the deepwater offshore oil regions of the North Sea, offshore Brazil, and the East Coast of Canada.

Why We Like Teekay:

We like Teekay because the business is improving. For starters, when energy prices began to dive in 2014, the entire energy shipping industry was hit hard as well (this is a big part of the reason these shares offer such a high yield). However, the business is now improving for a variety of reasons including Teekay’s improved liquidity, an improving macroeconomic environment, and Teekay’s new growth projects coming online.

Regarding liquidity, several things have happened to improve TOO’s position. First, Teekay actually cut the dividend on the common shares last year from 11 cents down to 1 cent per share. This was actually a good thing for the preferred shares because is freed up more cash flow for Teekay to use to support the preferred shares (remember, preferred shares are higher than common shares in the capital structure, which means Teekay has to support the preferred shares before the common). Also worth mentioning, these are cumulative preferred shares, which means if Teekay ever misses a preferred share dividend, they’re required to make it up later (i.e. they’re cumulative). Also very important, the dividend is qualified.

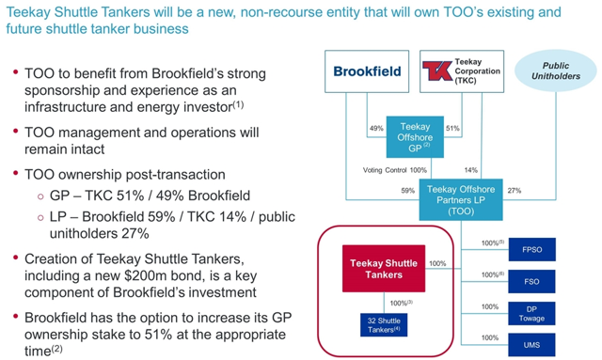

The next important liquidity consideration is that in the second half of last year, separate company Brookfield came is an provided liquidity in exchange for an ownership position in some of Teekay’s assets. This gave Teekay the liquidity it needed in challenging times, and resulted in the formation of Teekay Shuttle Tankers, as shown in the following graphic.

And the next important liquidity consideration is the improving macroeconomic environment. Specifically, oil has traded over $70 this year (its highest level since 2014), and the global economy is strengthening (also worth noting, oil companies have a higher cash flow at $60 to $70 per barrel today then what they had at an oil price of $100 per barrel in 2014, according to Teekay's conference call).

Another important liquidity consideration is that growth projects are coming online for Teekay. Specifically, the company's leverage will naturally come down as new project start adding new cash flow. For example, during the most recent quarterly call Teekay noted “we expect an increase in cash flows for the first quarter of 2018 primarily due to the continued startup of our growth projects.” And this comes on top of the most recent earnings announcement whereby TOO beat revenue estimates significantly.

Bottom Line:

Overall, Teekay’s business and liquidity are improving, yet these preferred shares still offer an attractive yield and a discounted price. We expect it is likely these shares will get redeemed by Teekay in two-years (as soon as Teekay is contractually allowed to redeem them on 4/20/2020), in which case investors would have collected 9% in income each year, plus the price appreciation, thereby resulting in a total annual return (dividends plus price appreciation) of approximately +11.5% each year. If conditions improve dramatically before then, the shares could trade at a significant premium to "par" ($25) in which case investors might consider selling sooner, however we're cognizant of long-term versus short-term tax returns.