Be fearful when others are greedy, and greedy when others are fearful. Buy when there is blood in the streets. Whatever contrarian, value-investor, mantra you like, we continue to like this high-yield investment, and we could see some interesting market action this week.

Frontier Communications 2023 Bonds, Yield: 11.0%

We like Frontier's 2023 bonds, even though the stock continues to struggle. The main reason we like the bonds (besides the attractive 11% yield) is that the company continues to generate cash flow to support the bonds. Further, if cash flow gets too tight, the company can cut the big dividend on the stock to free up more cash to support the bonds. We've written about these bonds before, for example...

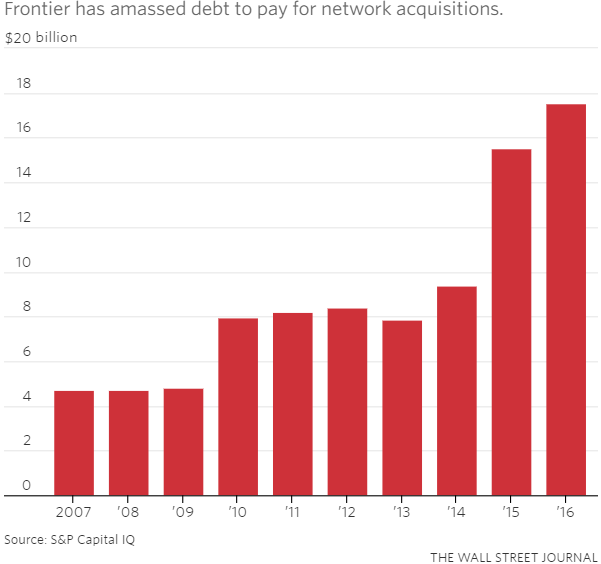

And today (Monday 7/10), the company is expected to complete a 15-for-1 reverse stocks split (mainly to keep the shares from being delisted by the Nasdaq because the price has fallen too low). As a reminder, Frontier recently (in the last few years) racked up a lot of debt to pursue a landline strategy as other telecommunications companies exited landlines to purse wireless and other opportunities. Here is a view of the rate at which Frontier’s debt has grown.

However, as debt has grown, the landlines strategy continues to face significant challenges as more and more customers cancel their service, as shown in the following graph.

We believe there is an end in sight to the cancellations considering many customers have no other viable options due to their off-the-beaten-path (often rural) locations (and management also expects attrition to slow). Further, Frontier receives government subsidies to help support telecommunication access for customers when there is no other option, and this gives Frontier more support to ultimately pay the bonds.

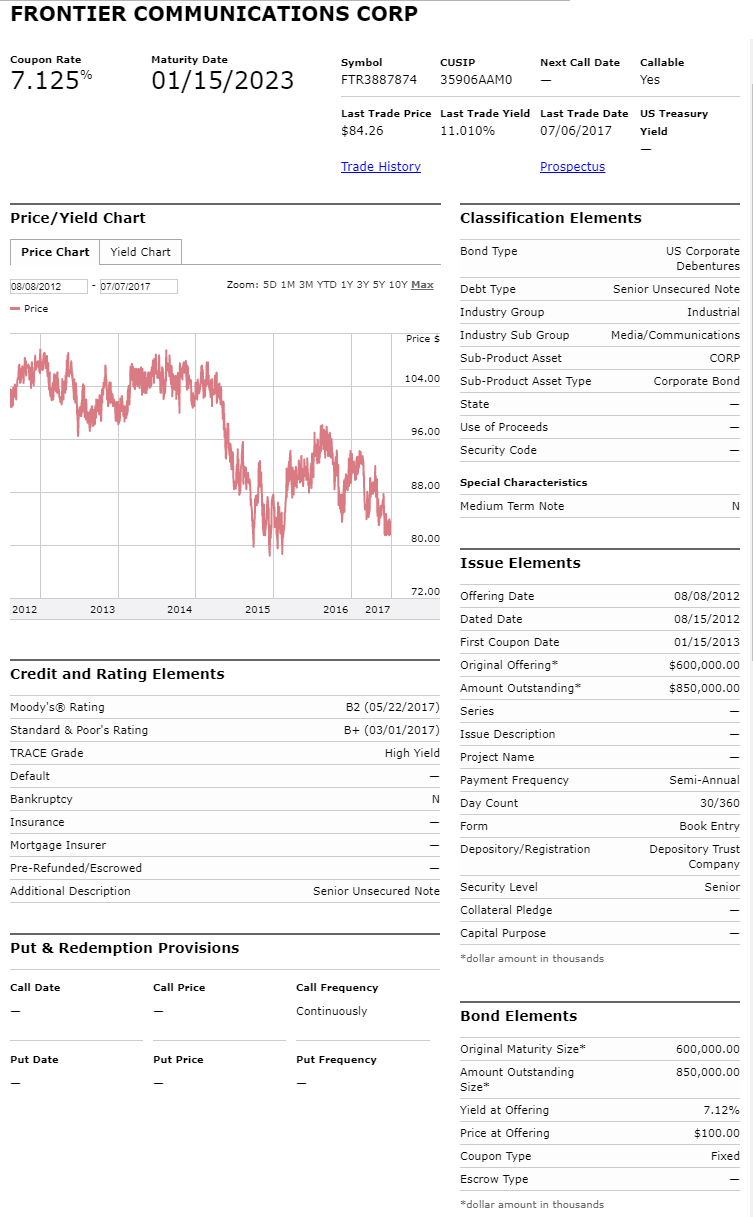

As a reminder, here is a graphic of the specific Frontier bonds

You’ll note, these are senior unsecured notes that mature in 2023 (five and one half years from now). The bonds are unsecured, which frightens off many investors, and it’s also the reason the yield is so high and attractive in our view (currently 11.0%). Especially considering the company can cut its dividend (again) to support the bonds (debt is higher in the capital structure than equity). Plus, the company continues generate significant cash flow, and management believes customer attrition will slow.

Make no mistake, these bonds are risky, and there will be more difficult challenges for the company ahead. Frontier may have to cut the dividend again, depending on how quickly attrition slows, and how much capital they use to support their network (they’re planning on spending $1 billion in 2017 to support the network). However, given the cash available from operations, the cash that can be accessed by cutting the dividend (if needed), management's expected slowdown in attrition, the fact that many customers have no other viable options, and support from the government, we believe the bonds are “money good.” In fact, if the equity gets much cheaper, we could see a deal whereby a deep-pocketed acquiring company could come in, refinance the debt at a lower rate, and further ensure the bonds payoff.

If you are looking for a high-yield, we believe these Frontier bonds are worth considering. And as a reminder, you can view all of our current holdings here.