If you have a long-term investment horizon, you might consider investing in this disciplined growth stock. It pays only a small dividend now, and its share price is volatile, but 5-years from now you will probably wish (or be glad) that you bought shares.

NVIDIA Corp (NVDA), Yield: 0.37%

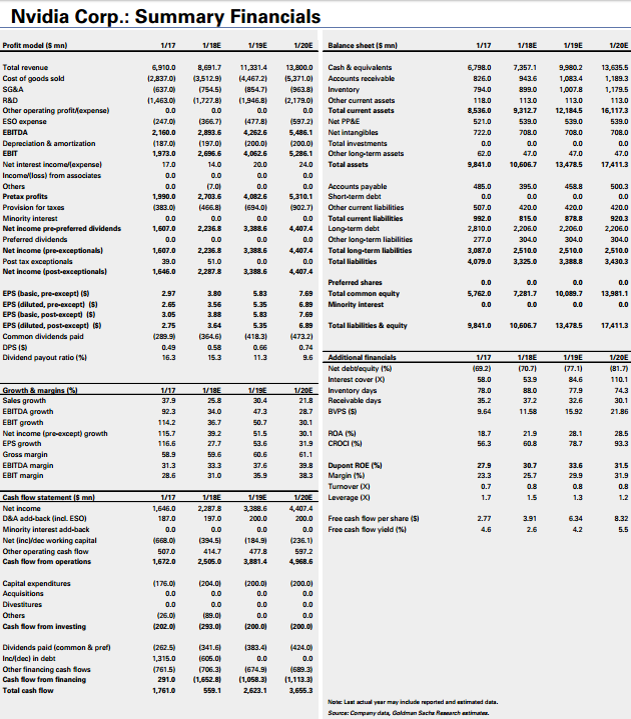

P/E (TTM): 50.0x, Forward P/E: 42.8x

EV/EBITDA: 35.2x, Forward EV/EBITDA: 30.8x

Nvidia’s stock price has experienced a dramatic increase in recent years as the company continues to transform itself to meet the growing graphics processing unit (GPU) and artificial intelligence needs of gaming, data center, automobile, and professional visualization industries.

Nvidia continues to have tremendous growth opportunities ahead as the total addressable market is large and growing. And despite high near-term price multiples (P/E, and EV/EBITDA ratios), Nvidia remains relatively inexpensive based on longer-term growth opportunities, particularly in data centers and gaming.

We believe Nvidia is an attractive business in an attractive industry, and the stock price may continue to increase significantly in the coming years, however given the uncertainty regarding the size and timing of future growth (and its relatively higher beta), it may experience significant volatility.

Summary of the business and the industry

The semiconductor industry is growing rapidly, and Nvidia products are an increasingly integral solution. The business can be broken down into four main segments:

Datacenter: All of the world's major Internet and cloud service providers now use NVIDIA Tesla-based GPU accelerators (e.g. AWS, Facebook, Google, IBM, and Microsoft as well as Alibaba, Baidu, and Tencent).

Automotive: NVIDIA’s Drive PX2 is a scalable architecture, and 80+ companies are currently developing with it. For example, every Tesla Motors vehicle now comes equipped with Drive PX2 for full self-driving capabilities.

Gaming: “According to Mercury, who published 1Q GPU unit data on 5/18, Nvidia held share for the discrete GPU market as a whole, with a gain in desktop GPUs offsetting a loss on the notebook side. Specifically, Nvidia’s desktop GPU unit market share improved from 71% in 4Q16 to 73% in 1Q17, while the company’s share in notebook GPUs declined to 66% to 63% over the same period.” –Goldman Sachs

Professional visualization: the most advanced visualization and simulation capabilities to meet the needs of the most demanding professionals.

Brief history of the company

The name of the company comes from Invidia in Roman mythology who corresponds to Nemesis. Nvidia was founded in April 1993 by Jen-Hsun Huang (CEO as of 2017), a Taiwanese-born American, previously Director of CoreWare at LSI Logic and a microprocessor designer at Advanced Micro Devices (AMD); Chris Malachowsky, an electrical engineer who worked at Sun Microsystems; and Curtis Priem, previously a senior staff engineer and graphics chip designer at Sun Microsystems. The founders received venture capital funding from Sequoia Capital.

Valuation

We assign Nvidia a 12-month price target of $171. This price target is consistent with Goldman Sachs’ June 13th 12-month price target, and is based on 32x Goldman’s FY19 EPS forecast of $5.35. For perspective, NVDA trades at a discount for its growth profile as shown in the following exhibits.

Worth noting, last week, Citi analyst Atif Malik raised his price target for Nvidia to $180 from $145 and he laid out his bull case of $300 for the shares. According to Malik, “Even after rallying 38% year-to-date, the stock is not pricing in continued growth in data center sales as well as an auto inflection in 2018 driven by the company's open source automated vehicle.” Malik's bull case scenario of $300 assumes $24B in sales and $8.50 per share of earnings power on 50% share in the $30B data center opportunity, $5B of auto opportunities and "steady" gaming contribution. Malik maintains a Buy rating on Nvidia shares.

Competition

The following table gives an overview of the larger competition (by market cap) in the semiconductor industry (there are dozens of smaller semiconductor companies not included in the table).

With regards to graphics products, NVDA competes with AMD on offerings for high-end gaming products. And in the stand-alone GPU space, Nvidia is ahead of AMD in market share. However, Intel is above both with its combined CPU-GPUs, controlling approximately 75% of the market.

With regards to data centers, NVDA has been gaining some market share versus the larger Intel. The datacenter business is currently at an annual run-rate of $1.6 billion versus the company’s projected 2020 TAM of $30 billion.

Regarding the automobile segment, there are many companies vying for market share. However, NVIDIA’s Drive PX2 is a scalable architecture, and 80+ companies are currently developing with it.

Management- (Capital Allocation)

Nvidia pays only a small dividend, and has taken on some debt in recent years. Share repurchases have been significant, as shown in the following chart.

Catalyst

The upcoming August earnings announcement could be a catalyst for continued stock price appreciation as the company continues to significantly beat the street’s earnings estimates quarter after quarter.

Additionally, if Nvidia continues to gain data center market share on Intel that could be a catalyst for more price appreciation.

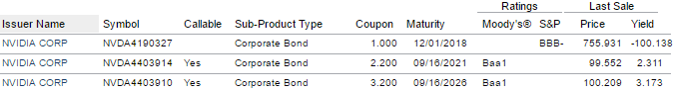

The capital structure

According to GuruFocus, Nvidia’s weighted average cost of capital is 11.24%, and Nvidia’s return on invested capital is 134.14% (calculated using TTM income statement data). Nvidia has several series of outstanding debt securities, as shown in the following table.

Recent Price action

Nvidia has experienced significant price gains in recent years.

Short interest is currently at 4.1% of shares outstanding.

Special/Unique

Nvidia is a leader in graphics processing units (GPUs). This makes the company the leader in gaming, but it also gives the company an advantage in the growing artificial intelligence space as the technology is proving valuable there as well.

Quality

Nivida products are high quality, and Nvidia is the industry leader in video gaming. The processing power of Nvidia GPU’s make it valuable in newly emerging artificial intelligence technology.

Risks

Perhaps Nvidia’s largest risk is simply if the company fails to meet the evolving needs of markets, including identifying new products, services and technologies.

Per the company’s annual report, another risk is: “we receive a significant amount of our revenue from a limited number of customers within our partner network and our revenue could be adversely affected if we lose any of these customers.”

Yet another risk is that the price has increased dramatically and quickly; the market has high expectations for Nvidia, and if the company doesn’t fully meet the market’s expectations then the stock price could fall significantly.

An additional risk is the competition; Nvidia has an advantage over the competition currently with regards to its GPUs, but competitors may design better solutions in the future.

Conclusion:

Overall NVDIA is an attractive company in an attractive industry. It is psychologically difficult for many value investors to purchase shares of a stock after it has just rallied so hard like Nvidia has. However, we do believe their is a good chance the shares will be trading very significantly higher 5-years from now. We currently do NOT own shares of Nvidia, but we have added it to our watch list, and we may consider initiating a small position in the near future (particularly if the shares pullback) within our Blue Harbinger Disciplined Growth portfolio. For your reference, you can view our current holdings here.