There was an interesting Warren Buffett interview last week where the “Oracle of Omaha” gave a handful of very wise advice to investors. However, we couldn’t help but notice, he seemed to make a glaring fundamental mistake. This article reviews Buffett’s good advice, postulates a couple reasons why he could have made his glaring fundamental mistake, and we finally offer a smart way (a specific security) to take advantage of Buffett’s good advice without making the same big mistake.

The Good Advice...

Here is a link to the Warren Buffett interview…

And in the interview, Buffett was basically explaining why so many investors would be better off using index funds to save for retirement instead of trying to actively manage (lots of buying and selling) their investment portfolios. For the most part (NOT entirely) we agree with the following Buffett quotes from the interview:

"Costs really matter in investments… If returns are going to be seven or eight percent and you're paying one percent for fees that makes an enormous difference in how much money you're going to have in retirement." - Warren Buffett

Buffett is absolutely right here. Fees do add up, and those costs compound against you over time. Every dollar you can save, is a dollar that will compound and grow over time. This is the exact reason why we believe some investors are better off investing on their own instead of using a full-service broker. In fact, the investment performance we show on his website compares us to the performance of a full service broker.

And in the cast of the full service broker performance, you can see just how harmful expensive fees can be over time, considering all of our portfolios are beating the “full service broker” performance (full service broker factors in the expensive fees). In fact, the basic S&P 500 is beating all of the full-service broker performance shown on this website because of the expensive broker fees.

"Keep buying it through thick and thin, and especially through thin… The temptation when you see bad headlines in newspapers is to say, well, maybe I should skip a year or something. Just keep buying… American business is going to do fine over time, so you know the investment universe is going to do very well.” -Warren Buffett

This another piece of wise advice from Buffett. Specifically, timing the market (quickly getting in and getting out at just the right time) is practically impossible. This is why we prefer to stay fully invested (no cash, unless we need it for a specific expense) because over the long-term the market goes up, and as an investor you don’t want to miss out on those gains. Data shows that many investors buy and sell and the exact wrong times. It’s tough to hold (or buy more) when the market is down, but that is usually the exact right thing to do.

The Bad Advice…

“The trick is to essentially buy all the big companies through the S&P 500 and to do it consistently…” -Warren Buffett

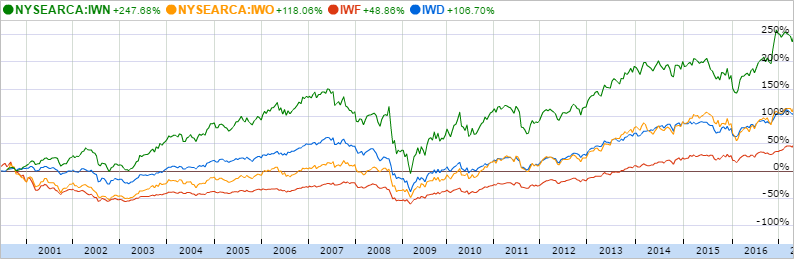

Buying all the “big” companies is an okay strategy, but mountains of research and empirical data show that it is actually the SMALL companies that do the best over the long-term. In fact, it is the small cap value companies that do the best. This has been proven time and time again, over the long-term (10+ year horizons) that small cap value has the best returns, NOT the “big” companies that Buffett describes.

For example, Eugene Fama, the most often quoted person in economic/investment research papers, has proven and shown this decades ago (and continues to prove it in more recent papers) through his three factor model (small cap is one of the factors). Also, as the following charts show, small cap and value have continued to crush large cap over the long-term.

Why Would Buffett say Such an Incorrect Thing?…

Warren Buffett is one of the most successful investors of all time, so understandably we might want to give him the benefit of the doubt. Specifically, perhaps there is some good reason why he would have said something (buy big companies) that seems so obviously incorrect. Here are two reasons why he may have made this “mistake.”

- Buffett’s company (Berskshire Hathaway) is so large that Buffett can only invest in large companies at this point in his career. Specifically, Buffett cannot easily invest in smaller companies because he’d have to buy entire companies just to make them a meaningful allocation, and this would create all kinds of integration and reporting challenges and headaches. For example, With a $400 billion market cap, if Buffett were to invest 1% of his portfolio in a small cap company then he’d have to spend $4 billion… and that’s larger than an entire small cap companies (small caps are generally $2 billion of less!). Berkshire Hathaway is huge.

- Maybe Buffett hates volatility. Small cap companies are more volatile that large cap companies in the short-term, but in the long-term small cap companies perform better. There have been papers written about Buffett’s preference for low volatility companies (so it’s less risky for Berkshire to borrow money for more investments).

Whatever the reason for Buffett’s recommendation to buy “big” companies, the data and research shows that over the long-term, small cap companies (particularly small cap value companies) perform the best.

How to Invest in Small Cap Value...

Our Blue Harbinger Smart Beta portfolio takes advantage of the long-term benefits of small cap and value stocks. And it does so in a low-cost fashion. For example, the large cap Vanguard S&P 500 ETF Buffett was talking about (VOO) charges a 0.06% management fee (extremely low!). However, Vanguard also offers an “all cap” (small and large cap) ETF (VTI) that also charges only 0.06% management fee. So this way investors get the benefits of adding small cap stocks (remember, they outperform over the long-term), and they also get the benefits at the same low cost. In fact, we own VTI in our Blue Harbinger Smart Beta portfolio.