Be fearful when others are greedy, and be greedy when others are fearful. This week's members-only investment idea is another big-coupon high-yield bond worth considering, The market remains very afraid of this bond, but the company appears to be turning the corner...

An Attractive 15.1% Yield

Walter Investment Management Corp (WAC)

Walter Investment Management Corp (WAC) services and originates residential loans (including reverse mortgages), and by many measures the company is currently in distress. For example, its stock price has fallen from nearly $50 in 2013 to below $3 now, and its 2021 high-yield bonds trade at a significantly discounted 76 cents on the dollar. Despite these dramatic declines, WAC’s business is turning the corner (impairments and goodwill write-offs are largely in the rearview mirror now), and the market is again believing in its desire and financial wherewithal to support its debts (the bond prices have rebounded dramatically, but they are still on sale). Specifically, we like 15.1% yield and big coupon payments on WAC’S 2021 bonds.

The Business

Walter Investment Management Corp. is a diversified mortgage banking firm focused primarily on the servicing and origination of residential loans, including reverse loans. The Company operates through three segments: Servicing, Originations and Reverse Mortgage. The Servicing segment consists of operations that perform servicing for third-party credit owners of mortgage loans, as well as its own mortgage loan portfolio. The Servicing segment also includes Insurance, and Loans and Residuals businesses. The Originations segment consists of operations that originate and purchase mortgage loans that are intended for sale to third parties. The Reverse Mortgage segment consists of operations which purchases and originates home equity conversion mortgage that are securitized, but remain on the consolidated balance sheet as collateral for secured borrowings.

The Financials

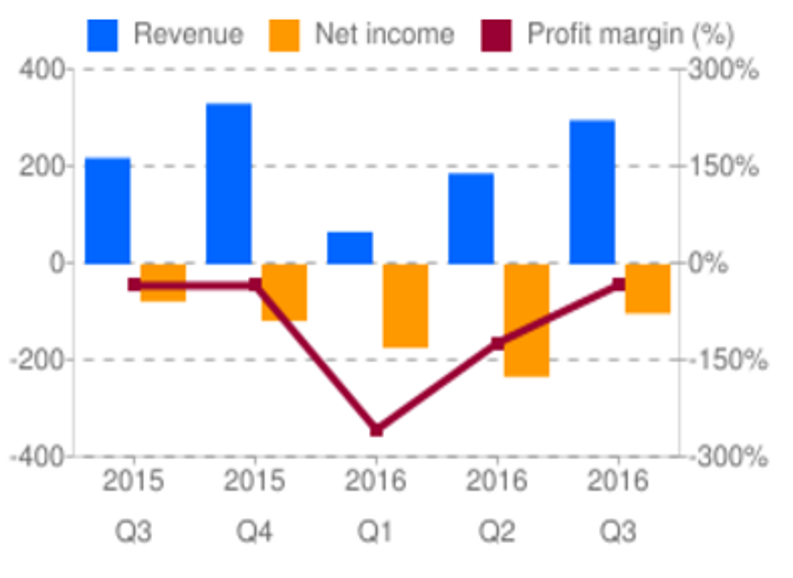

Per the following chart, WAC has been generating negative net income.

And as the following Income Statement shows, WAC produced positive adjusted earnings in only one of its three main segments (Originations).

The Will (And Wherewithal) to Succeed

However, we believe WAC has demonstrated the will (and financial wherewithal) to success, and the company s turning the corner. For starters, WAC has taken a variety of actions that demonstrate it wants to succeed. For example, WAC recently restructured its leadership team with WAC COO and President of Ditech Financial, David Schneider departing on October 12th, and heads of key operating units now reporting directly to CEO Anthont Renzi.

Additionally, WAC continues to dramatically improve its capital efficiency by: (1) Repurchasing$47.5 MN principal balance of Convertible Notes last quarte for $24.8 million, (2) Negotiating documents for WCO asset sale and related transactions, (3) driving closed and pending “mortgage servicing rights” (MSR) sales to New Residential Mortgage (NRZ) which are expected to generate ~$215 million in proceeds in the near term, and (4) pursuing options for the sale of Insurance business and Reverse Mortgage balance sheet. All of these actions are helping to improve WAC’s financial wherewithal, and they demonstrate the company wants to succeed.

The actions are also helping ensure that WAC can support its bond payments. And importantly, the debt markets are believing in WAC as evidenced by the strong rebound in the price of its outstanding bonds, as shown in the following chart.

However, and very importantly, the bonds still trade at a discount (76 cents on the dollar) and we believe they are money good.

One of the biggest reasons we believe WAC has the ability to keep paying the bonds is because the company’s recent losses are due largely to impairments and goodwill write-offs, both of which are now largely in the rearview mirror. For example, the company’s most recently earnings release indicated that the net loss for the quarter was larger than in same quarter a year ago because of “goodwill and intangible assets impairment charges of $60.6 million after tax, or ($1.68) per share, and non-cash charges of $17.0 million after tax, or ($0.47) per share.”

Moreover, referring to income statement we presented earlier, WAC had more than $300 million in impairments on goodwill and intangible assets over the last nine months. And per the company’s balance sheet, there are only about 133.4 million of goodwill and intangible assets remaining. According to CFO Gary Tillet (during the company’s most recent conference call), the unfavorable year-over-year variance is primarily driven by higher expenses primarily related to goodwill and intangible asset impairments… As a result of this impairment, the servicing reporting unit no longer has goodwill.

Basically, once the goodwill and intangibles impairments are exhausted, WAC’s Servicing unit can quickly become profitable. Specifically, revenues are basically a function of unpaid principal balance (UPB), and the big savings on impairment can easily turn the company profitable (thereby making t much ore feasible to support the bonds).

Risks

Investing in WAC’s 2021 bonds is risky, as the company continues to face challenges. And even though we consider the bonds attractive, there are a variety of risks worth considering. For example, WAC faces the constant risk of legal and regulatory changes that could dramatically impact its business. WAC highlights this as a risk factor in its most recent earnings release as follows:

Our ability to operate our business in compliance with existing and future laws, rules, regulations and contractual commitments affecting our business, including those relating to the origination and servicing of residential loans, the management of third-party assets and the insurance industry (including lender-placed insurance), and changes to, and/or more stringent enforcement of, such laws, rules, regulations and contracts.

Additionally, WAC highlights the following as risk factors:

Our dependence on U.S. government-sponsored entities (especially Fannie Mae) and agencies and their residential loan programs and our ability to maintain relationships with, and remain qualified to participate in programs sponsored by, such entities, our ability to satisfy various existing or future GSE, agency and other capital, net worth, liquidity and other financial requirements applicable to our business, and our ability to remain qualified as a GSE approved seller, servicer or component servicer, including the ability to continue to comply with the GSEs’ respective residential loan and selling and servicing guides;

Risks related to our substantial levels of indebtedness, including our ability to comply with covenants contained in our debt agreements or obtain any necessary waivers or amendments, generate sufficient cash to service such indebtedness and refinance such indebtedness on favorable terms, as well as our ability to incur substantially more debt.

Further, WAC is sensitive to a variety of market and economic factors, as it describes in its most recent earnings release:

Changes in prepayment rates and delinquency rates on the loans we service or sub-service;

A downgrade of, or other adverse change relating to, our servicer ratings or credit ratings;

Local, regional, national and global economic trends and developments in general, and local, regional and national real estate and residential mortgage market trends in particular, including the volume and pricing of home sales and uncertainty regarding the levels of mortgage originations and prepayments.

Changes in interest rates and the effectiveness of any hedge we may employ against such changes;

Conclusion

We believe WAC’s 2021 bonds are a risk that is worth considering. Specifically, the company has been making significant efforts to improve its capital efficiency and to support its bond payments. And the intangible impairments that have dogged the company are now largely in the rearview mirror. Further, the market is an increasing believer in WAC as evidenced by the strong price appreciation in the bonds. And despite the gains, the bonds still trade at an attractively discounted price, in our view. If you are an income-focused value investor, we believe the big 7.875% coupon payments and 15.1% yield to maturity on these attractively discounted 2021 bonds may be worth considering for an allocation within your diversified investment portfolio.