The shipping industry has been decimated in recent years as measured by the Dow Jones Global Shipping Index which is still down nearly 50% since mid-2014 (and it now pays an 11.9% yield!). And while there may be some very valuable contrarian opportunities in the space, many shippers are in deep distress and there will likely be more bankruptcies. This article highlights three ways to play the space.

Overview:

When we talk about the global shipping industry, we are referring to companies that use large ships to transport goods and materials such as oil, gas, coal, grain, steels, and sugars, to name a few. The industry has been in decline since mid-2014 when oil and commodity prices started to fall. Over supply (too many ships) and slower demand from emerging markets has also weighed heavily on the space. Further, many companies have already filed for bankruptcy protection (e.g. Shagang Shipping, Daebo Shipping, Copenship, Winland Ocean Shipping and Hanjin Shipping), and there are likely more bankruptcies to come as the industry adjusts and capitulates.

However, the companies that survive the extended downturn will be positioned to reap significant rewards. Specifically, they will be leaner operators, there will be less competition, and they will benefit from any uptick in the industry when it eventually comes. And there are signs the space is starting to turn around.

Three Ways to Play the Shipping Space

1. Navios Martime Holdings (NM) Bonds, (~10% and 18% Yields)

The highest yielding opportunity we describe in this article is Navios Maritime, and the two (2) series of high-yield bonds that the company has outstanding. Navios is a seaborn shipping and logistics company that is currently in the process of recovering from deep distress. Specifically, Navios has gone to extreme lengths to preserve cash flow in an attempt to weather the extended industry downturn.

More specifically, Navios has bought back deepy discounted high dividend paying preferred stock, they bought back deeply discounted bonds (to reduce their interest payments), they were able to renegotiate reduced bank debt cash requirements, they eliminated the equity dividend (less recently, back in 2015), they reduced their break even charter fleet, and they’re leveraging economies of scale with their Navios affiliates. Navios is going to great lengths just to survive (preserve cash), and they are very well-positioned now to benefit if the industry does turn around soon.

There is evidence to believe the industry is turning around. For example, seaborn dry bulk trends are already recovering from the earlier lows as shown in the following graphic.

Additionally, Navios bonds and steadily increasing in value (back closer to par) in an indication that the market has increasing faith that the company will survive.

Even Navios stock price is showing signs of improvement.

Navios explains in their recent earnings presentation that they are benefitting from continued market demand combined with changing supply dynamics (i.e. increase scrapping and slippage across the industry are materially reducing new building orders- a good thing for Navios and the other shipping survivors).

Navios has two main series of debt outstanding that are increasingly attractive…

First, Navios offers some bonds maturing in 2021 that pay an 8.125% coupon, and currently trade at 0.925 cents on the dollar, as shown in the following graphic.

All in, that’s a yield to maturity of around 10% assuming the bonds don’t default. Very importantly, these bonds are secured by a “first mortgage note” on Navios ships. This is extremely important because if Navios does go into bankruptcy, these bonds are back stopped by the value of the ships. And Navios fleet is a valuable asset.

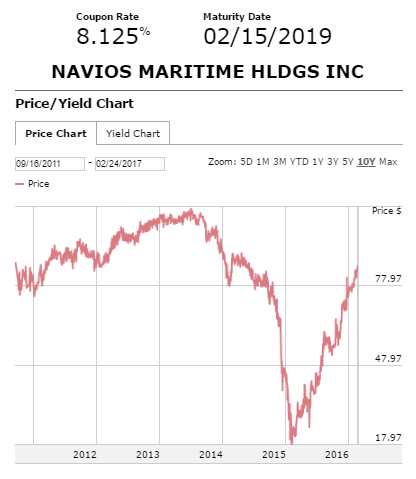

Second, Navios offers some bonds that mature sooner, 2019, offer the same size coupon payments (8.125%) and trade at a bigger discount thereby offer a higher yield to maturity of nearly 18%, as shown in the following graphic.

However, the main difference with these bonds is that they are corporate debenture bonds, which means they’re backed by the credit of the company, but NOT by its assets. Therefore, if Navios goes into bankruptcy before paying back these bonds, the bond holders could be out of luck (i.e. they may not get all their money back). However, based on the improving conditions we’ve described above, it seems increasingly likely that these bonds are money good.

2. Shipping Industry Equity ETF (SEA) 11.8% Dividend Yield

If Navios is too risky for your blood, then another way to play the shipping industry is via the Guggenheim Global Shipping ETF (SEA). This take a diversified approach, owing a basket of over 20 global shipping companies. The advantage of this ETF is they you will benefit as the overall industry rebounds. You don’t have to worry about picking winners and loser because the ETF will inevitably hold some winners and some losers, but in aggregate it pays a big yield and it will increase in value if and when the shipping industry improves. However, the downside is that if the industry doesn’t improve (i.e. if there is another shoe to drop) they you will not recognize gains in the near future. Additionally, the high yield on the index (currently 11.8%) may experience some dividend cuts. Also, this ETF charges a somewhat exensive management fee of 0.65%. You can view the factsheet for this index here.

3. Tskaos Energy (TNP) 4.3% Dividend Yield

The third way to play the shipping industry is via Greek shipping company Tsakos Energy. This is one of the shippers that has faced the same industry-wide challenges as other shippers, but has still managed to stay profitable in 2014-2016 (Q4-16 results pending). And even though Tsakos cut its dividend at the end of 2016, it still pays a dividend, which is an impressive feat in these market conditions (remember, for comparison, Navios, as described previously, is a shipper that cut its dividend to zero, it is not profitable, and it has made draconian cost cuts just to stay afloat). And while both Tsakos and Navios should both benefit handsomely if/when the industry turns around, Tsakos is much stronger financially than Navios. Additionally, we own Tskaos in our Blue Harbinger Income Equity Strategy. We were early on adding Tsakos to the strategy (it has lost value since we purchased), we continue to believe Tsakos is an attractive, high-income way to play the shipping industry, especially considering we believe a rebound (perhaps a big one) will eventually come once all of the less financially sound organizations have been shaken out, and economics improve.

You can view all of our current Blue Harbinger holdings here...