As many of you are aware, we’ve had great success owning New Residential (NRZ) over the last 2-years. It has raised its giant dividend twice and its price is up very significantly. But is it finally running out of steam? This article briefly reviews the evolution of New Residential’s business in recent years, followed by our views on whether there is still gas in the tank, or if it’s finally time to take your chips (and your profits) off the table to invest in something better.

Our Views on New Residential:

To get right to the point, we continue to own our shares of NRZ because the company continues to make smart moves to position itself for more success, however we continue to watch it closely because if NRZ doesn’t stay out in front of its evolving industry it could quickly slow down and disappoint. In short, we continue to own shares (for the safe dividend and continued price appreciation potential), but we’re watching it closely to make sure it keeps making the right moves.

A Quick Review of NRZ’s History:

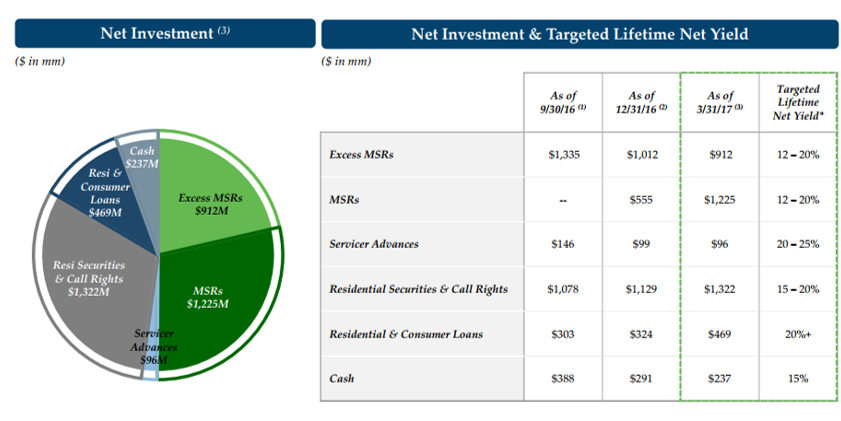

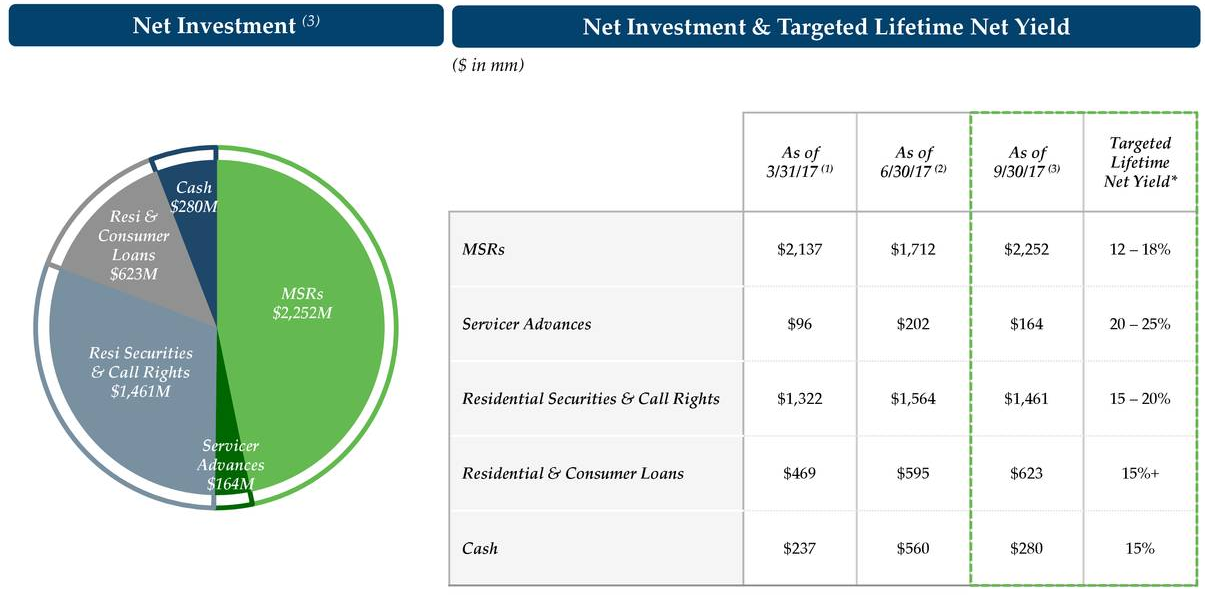

NRZ has been significantly changing its business model in recent years to adjust to evolving market conditions. For example, the following three graphics show the evolution of NRZ’s net investments over the last two years since we have owned the shares in our Blue Harbinger Income Equity portfolio.

2015:

Q1 2017:

Current:

What should stand out is the dramatic reduction in Excess Mortgage Servicing Rights (Excess MSRs) to more basic and direct Mortgage Servicing Rights (MSRs). Excess MSRs were essentially a creation following the financial crisis that gave someone (in this case NRZ) control over mortgage servicing if the first mortgage servicer couldn’t handle it. NRZ was basically collecting money for owning the Excess MSR without ever actually servicing any of the mortgages (NRZ outsourced the excess servicing to someone else).

This business model worked great for NRZ because they were largely the only game in town as the big banks were forced to shed this type of “risky” business due to more stringent regulations following the financial crisis. And as NRZ expanded into this Excess MSR business aggressively, they were able to make a lot of money and pay a lot of big dividends to shareholders.

The problem recently has been that NRZ’s opportunities for growing the Excess MSR business have diminished as they’ve already captured a huge portion of this market, and also the growth opportunities for the Excess MSR business are dimished because the distress of the financial crisis is falling further into the rear view mirror. Further, NRZ’s inability to actually service mortgages in house limited the deals they were able to make (NRZ owned the servicing rights, but they didn’t actually service the mortgages—this was outsourced). This was a fantastic business over the last few years, but as the industry moves forward, NRZ needs to keep evolving.

NRZ’s New Opportunity: Shellpoint Partners

It was announced earlier this month that NRZ is acquiring Shellpoint Partners, and this is a smart move in multiple ways because it will allow NRZ to continue evolving with the evolving industry. The following graphic show some of the things NRZ will gain from this transaction.

Very Importantly, NRZ is gaining a mortgage servicer and originator. This is huge for NRZ because it allows the business to keep growing. For some perspective, NRZ has been unable in recent years to acquire additional MSRs in some deals because the sellers preferred to work only with companies that had in house servicing. Prior to this deal, NRZ had to outsource all servicing. This deal is very important because it will not only give NRZ access to more deals (because they’ll soon be able to actually service in house), but it will also allow NRZ to grow new business opportunities with its origination capabilities.

The other big advantage of this deal is that it reduces the risk associated with a couple of distressed mortgage servicers upon which NRZ has been highly dependent (Ocwen and Ditech) as described in detail in our previous NRZ article:

Specifically, NRZ was at risk of having some of its MSRs deemed worthless if Ocwen and/or Ditech defaulted. However, NRZ’s new serving platform (via Shellpoint) moves NRZ in the direction of being able to service those mortgages in-house, thereby dramatically reducing risks.

Dividend Strength:

Also importantly, the new Shellpoint deal will help ensure NRZ is able to keep covering and growing its big dividend. For perspective, the following chart shows that NRZ has been covering its dividend with a healthy margin of safety.

Specifically, NRZ’s core earnings continue to cover the dividend with something left over for either special dividends, or more smart acquisitions, such as Shellpoint.

Conclusion:

We believe NRZ’s dividend is well-covered, and its business continue to have growth opportunities thanks to management’s constant smart decisions to evolve with the evolving industry. However, we continue to watch NRZ closely because as soon as the growth opportunities start to fade, so too might the share price. Long NRZ

You can view all of our current Blue Harbinger holdings here.