Ventas, Inc. (VTR) is a healthcare REIT that pays a big 5.1% dividend yield. But its share price has declined dramatically since last summer and particularly since the November election. And considering the favorable demographic tailwinds at its back (e.g. an aging population, and rising healthcare needs and wherewithal), it might seem like now is a great time to “buy low.” This article reviews the prospects for Ventas going forward, and provides our strong views on whether it’s an attractive income-investor opportunity or a dangerous value trap.

To get right to the point...

We believe Ventas currently presents an attractive opportunity, and it’s worth considering if you are an income-focused investor. Specifically, we’re attracted to its prudently diversified business, strong credit ratings, the two mega-trends we expect it to benefit from (i.e. aging demographics and a long-runway for healthcare REIT growth), it’s big (growing) dividend, its ample dividend coverage, and its current valuation, to name a few. We also review a few of the risks faced by Ventas.

For reference, we first wrote about Ventas last summer (in a members-only report) when the stock was trading at a much higher price than it is now. The article was titled:

“Ventas: Adding this Big Dividend REIT to our Watch List”

We liked Ventas back then, but concluded that article by saying…

“We like Ventas. It’s an attractive healthcare REIT that will benefit from continued demographic growth, it has exhibited low volatility, and has consistently generated cash flows to support and grow its already attractive dividend yield. However, its price has rallied significantly with the rest of the REIT industry, and its valuation is on the higher end of its historical range at 18.6 times FFO. And even though we believe it will eventually generate more than enough growth to back up its current valuation, and we believe the dividend is very safe, we do not currently own shares. Ventas will remain on our watch list, and we may purchase shares in the future if there is a significant price pullback.”

Whelp… that price pullback we were waiting for has arrived. And while we do NOT currently own shares, we are giving it some serious consideration. For your reference, the following paragraphs provide an update on some of the attractive qualities (and some of the risks) of Ventas…

Diversification:

The following chart shows the healthcare real estate segments in which Ventas invests, and we like that its diverse strategy allows it to consider a wide range of opportunities.

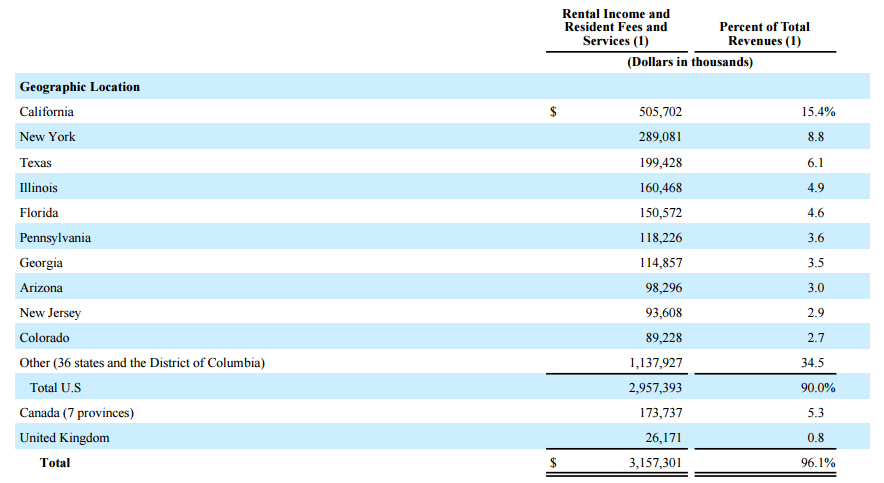

Additionally, Ventas is diversified across US states and regions as shown in the following table.

Granted there are some concentration risks, and we cover risks in more detail later, but the following paragraph from Ventas’ annual report is worth considering.

“For the year ended December 31, 2015, approximately 37.7% of our total NOI (excluding amounts in discontinued operations) was derived from properties located in California (14.7%), Texas (6.7%), New York (6.0%), Illinois (5.5%), and Florida (4.8%). As a result, we are subject to increased exposure to adverse conditions affecting these regions, including downturns in the local economies or changes in local real estate conditions, increased construction and competition or decreased demand for our properties, regional climate events and changes in state-specific legislation, which could adversely affect our business and results of operations.”

Also important to note, Ventas has been exiting the high-risk skilled nursing segment of the market (it’s high risk due to the threat of changing health care laws). For reference, our earlier pie chart shows this segment at only 1%. Ventas spun off most of this business into a separate REIT, and according to a recent press release, they’re about to get rid of it all…

“Our 2017 forecast reflects our continued strategic actions to create short- and long-term shareholder value, including: disposition of nearly $1 billion in assets, including substantially all of our skilled nursing portfolio at a premium valuation…”

The fact that Ventas is well-diversified, and has largely exited skilled nursing facilities, has contributed positively to its strong credit rating as shown in the following table.

Two Mega-Trends:

We believe Ventas will benefit from two mega-trends that are not currently adequately baked into its stock price (more on valuation later). Fist, as we mentioned earlier, Ventas has demographics on it side. As the US population (and select international populations) age and have increased wealth to spend on healthcare, this will benefit Ventas. The following table provides a variety of useful metrics in this regard.

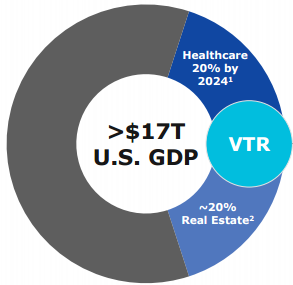

The second mega-trend is the expected growth in healthcare REITs. Specifically, the percentage of healthcare real estate owned by REITs is very low compared to the same percentage for other types of real estate as shown in the following table.

This suggests that while other REIT industries become saturated and have less room for growth, healthcare REITs (including Ventas- an industry leader) has a long runway for continued growth (we’ll have more to say about growth later). And for added perspective, this next pie chart shows just how big of a space the intersection of real estate and healthcare really is (i.e. lots of room for growth).

The Dividend:

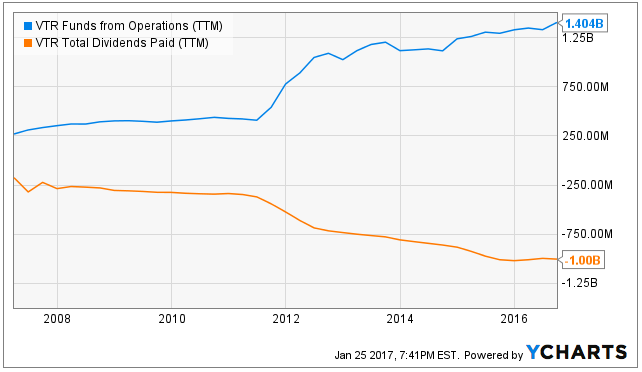

The big dividend yield (5.1%) is one of the main reasons many income-investors are attracted to Ventas, and in our view it is a very safe dividend. For example, the following chart shows Ventas’ Funds from Operations (FFO) over the last 12 months compared to the total dividends paid.

And as the chart shows, Ventas is consistently bringing in more FFO that it is paying out in dividends. This payout ratio is a good thing for the long-term sustainability of the dividend (i.e. they don’t need to borrow or use other cash just to pay the dividend). In fact, Ventas just announced last month that it increased its dividend payment (again) by 6% this time.

Also worth considering, Ventas offers a Dividend Reinvestment Program (DRIP) where by shareholders can automatically receive additional shares in lieu of a cash dividend. This is a good thing for both investors and the company (which are actually one in the same). First, the DRIP program mean Ventas needs to coe up with less cash every quarter to payout as dividends (because they’re offering more shares instead of cash). And the DRIP program is good for shareholders that like the company because it allows them to stay more fully invested with essentially now broker trading costs, and they get to purchase shares at a 1% discount to the market price.

Growth:

As we’ve mentioned earlier, Ventas has lots of growth potential. For starters, management just forecast continued FFO growth in 2017 (2017 normalized FFO guidance per diluted share is $4.12 to $4.18). And this next chart shows the company’s strong history of FFO growth.

Also, this next table shows analysts are forecasting EPS growth for Ventas next year, and those estimates have been increasing (a good thing).

Further, aside from simply growing FFO, Ventas expects more gains from successful asset dispositions. For example, as we mentioned earlier, Ventas expects to sell some of its skilled nursing facility assets (among other assets, as well) at a premium in 2017 to better align its assets with its strengths and strategy.

Valuation:

In addition to the multiple attractive qualities we’ve already covered, Ventas is trading at an attractive price/valuation. For example, this first chart shows Ventas’ price to FFO ratio is not unreasonable compared to recent history (and its certainly not unreasonable in our view given its future growth prospects).

For added perspective, this next chart shows historical price too FFO per share on a separate basis, and the price is on the lower end of where it has historically been relative to FFO.

And given Ventas’ continued high-growth, lower-risk prospects, the valuation is attractive in our view.

Risks:

For your consideration, we have highlighted a variety of risk exposures that are worth considering. For example, even though Ventas is fairly well-diversified, the company is still exposed to some concentrations risks in terms of geography and clients. Specifically, there is a relatively large concentration of investments in California. Additionally, properties managed by Atria and Sunrise account for a significant portion of Ventas’ revenues and operating income (any adverse developments in Atria’s or Sunrise’s business and affairs or financial condition could have a material adverse impact on Ventas). Further, Ventas’ leases with Brookdale Senior Living, Kindred and Ardent account for a significant portion of Ventas’ triple-net leased properties segment revenues and operating income (and again, any failure, inability or unwillingness by Brookdale Senior Living, Kindred or Ardent to satisfy its obligations under Ventas agreements could have a material adverse impact on Ventas).

Another big risk involves any changes in the reimbursement rates or methods of payment from third-party payors, including insurance companies and the Medicare and Medicaid programs. Such changes could have a material adverse impacts on certain tenants and operators in particular. Further, federal and state legislators and regulators have adopted or proposed various cost-containment measures that would limit payments to healthcare providers, and budget crises and financial shortfalls have caused states to implement or consider Medicaid rate freezes or cuts

Interest rates pose another significant risk. Ventas is exposed to increases in interest rates, which could reduce profitability and adversely impact the company’s ability to refinance existing debt, sell assets or engage in acquisition, investment, development and redevelopment activity. However, we have seen Ventas take a big interest rate related “hit” to its share price already a couple months ago following the new US president’s aggressive growth policies and the US Federal Reserve’s willingness to raise rates further (the market may have actually overreacted in a negative way, in our view).

Conclusion:

In our view, Ventas offers a big, relatively-safe, dividend yield (5.1%), and the shares are trading at an attractively low price, especially related to its future growth prospects from demographic trends, continued healthcare REIT growth opportunities, and Ventas’s continued company-specific opportunities. We don’t currently own shares of Ventas (we own a different, slightly higher-risk, higher-reward, healthcare REIT, Omega Healthcare Investors (OHI)), but we do believe Ventas is particularly attractive right now (given its low price), and it’s worth considering for a position in your diversified, long-term, lower-risk, income-focused, investment portfolio.