CenturyLink (CTL) is a big dividend (7.9%) telecom stock that is trading at an attractive price. The stock has been beat up over the last month (Mr. Market didn’t like earnings) and over the last several years (it cut its dividend in 2013, and market volatility has increased). We believe the market is overly negative on this stock, and now is a compelling time to add shares because the price is down, the valuation is attractive, and the dividend yield is outstanding.

About:

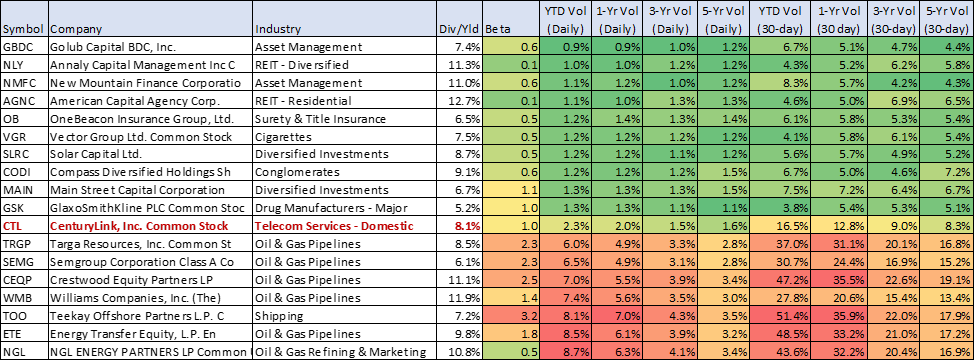

CentryLink is the third largest phone company in the US. The company provides local phone lines, high-speed Internet, and owns a fiber optic network and data centers. Once considered a very safe low volatility company by many “widow and orphan” type investors, CenturyLink has damaged its reputation after cutting its dividend in 2013 and volatility has increased since then. The following table shows CenturyLink’s beta and recent volatility relative to other big yield investments. Both of these metrics (beta and volatility) are still relatively moderate for a big dividend stock, but higher than many people are comfortable with for a telecom stock.

Valuation:

From a valuation standpoint, CenturyLink is extremely attractive. Using management’s 2016 free cash flow guidance from the Q1 earnings call ($1.8 to $2.0 billion), and the weighted average cost of capital from GuruFocus (6.4%), we can back into the company’s current market capitalization ($15.1 billion) by assuming a negative 6.2% growth rate. And this negative 6.2% growth rates seems much too pessimistic given the company’s recent performance and future opportunities. More specifically, we believe the market has overreacted thus created an attractive buying opportunity.

As an alternative method of valuation, we can discount the company’s annual dividend payment ($1.2 billion) by the cost of equity (9.16%) and assume a growth rate of 1.2% to again back into CenturyLink’s current $15.1 billion market capitalization. And again, the growth rate seems too pessimistic. More likely, CenturyLink will be able to grow its dividend considering it’s only paying out 63% of its free cash flows as dividends. And truthfully, the cost of equity should come down (get less expensive) for CenturyLink as volatility (i.e. the beta used in the cost of equity calculation) comes down (CenturyLink’s current beta of around 1 is too high for a telecom company and we expect it to come down in the years ahead)

In our view, by both valuation metrics (i.e. discounted cash flow and divided discount) CenturyLink is very undervalued by the market. And as an added level of confidence, we know CenturyLink receives an additional $500 million in cash per year from the US government via its “Connect America Fund” to support telecom services is less accessible (often rural) areas. This added cash flow increases our confidence in CenturyLink’s wherewithal to remain profitable.

Risk Factors:

CenturyLink faces a variety of risk factors worth mentioning. For example, the wireline industry is in decline as wireless, and some cable operators, provide more viable solutions. This will certainly weigh on CenturyLink’s business, but they should also have enough retention in many of the rural areas where they operate as they are still the most viable option. Additionally, much of the wireless induced wireline decline has already occurred.

Another risk is CenturyLink’s history of making large acquisitions which can be more operationally challenging than expected, and they can also add significant costly debt to the balance sheet. For example, CenturyLink completed deals with Qwest, Savvis and Embarq in the last half decade, all of which added operational challenges to the business.

Competition is actually the very first risk factor CenturyLink lists in its most recent annual report as they acknowledge the steep competition in the industry. Specifically, CenturyLink explains “we may not be able to compete successfully against current or future competitors.” This competition also includes rapid technological changes.

Regulatory and Legislative risk also exist for CenturyLink. For example, if Congress were to revoke or end the “Connecting America Fund” the CenturyLink would immediately face significant cash flow challenges.

Debt is another risk. CenturyLink’s debt to assets ratio is already over 40%. This will create challenges if interest rates rise significantly or if the company requires additional debt financing on top of the large amount they already have.

Conclusion:

Overall we believe the market is overly pessimistic on CenturyLink. It faces challenges, but it also offers significant price appreciation potential, and a very big dividend yield. We’re comfortable with the higher level of volatility for a telecom company because it’s still really not that high, especially when you factor in the smoothing effect of the big dividend. We expect the volatility and beta of CenturyLink to decline over the coming years, as the stock price increases and investors continue to collect big dividend payments. If you are an income-focused investor, CenturyLink is worth considering.