After suffering significant stock price declines from over $120 per share in early 2015 (to a low of $67.06 in January), we believe Union Pacific (UNP) is back on track (the price is back up to $88.40), and we believe it has significantly more stock price appreciation potential in the years ahead. And the nice dividend payments (currently 2.5%) made it much easier to ride out the recent volatility, and the dividend payments will continue to make it more enjoyable to own this stock going forward. We are long UNP.

For some flavor, Union Pacific is a railroad company (covering the western two-thirds of the US), and its stock price had declined since early 2015 mainly due to sharp declines in coal and industrial products freight revenues. The following slide and pie chart gives a good overview of Union Pacific’s revenue mix.

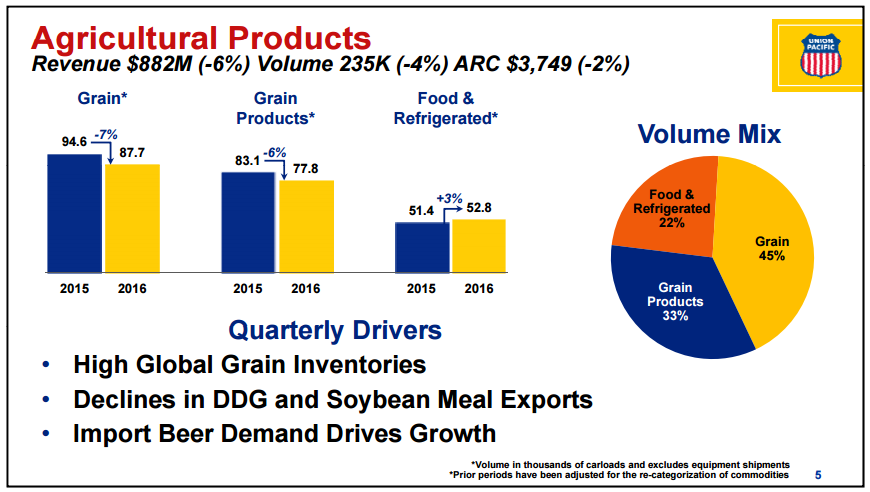

Coal (12%) has historically been a much higher piece of the pie (~20%) but has sold off as cheap natural gas has reduced its demand. However we believe UNP has some advantages in coal that we’ll cover later. For more detail, the following series of charts breaks down Union Pacific’s revenue mix, and they are worth reviewing if you want a better understanding of the business.

How has UNP responded to challenging market conditions?

Union Pacific’s management acted quickly in the face of declining market conditions to preserve (and improve) the operational efficiency of the company. For example, the company set record operating ratios in 2010, 2012, 2013 and 2014, and UNP continues to operate as a highly efficient business going forward. UNP will benefit from their highly efficient operations even more as the market cycle continues to turn and revenues continue to grow, profitably. In fact, one of UNP’s greatest advantages is its ability to adapt to challenging market condition by adjusting their revenue mix and quickly improving operating costs efficiencies.

Why does UNP have more price appreciation potential ahead?

In addition to UNP’s agility and flexibility in challenging markets (as mentioned previously), the company also has several advantages that will help its price continue to increase significantly in the future. For example, we’re currently nowhere near the top of the market cycle. With energy prices still depressed and industrial business down, Union Pacific’s stock price is down (cheap) and very attractive for long-term investors in our view. Additionally, beyond the current market cycle, the overall economy will continue to grow and Union Pacific will grow with it because of its wide sustainable economic moat.

Union Pacific has a strong competitive advantage (wide economic moat) in our view. For example, its railroads have strategic access to key west coast ports which are not easy for competitors to recreate. Also, coal in the western two thirds of the US (Union Pacific’s wheelhouse) is cheaper than coal in the Appalachian region of the US, thereby giving UNP’s business an advantage particularly as coal competes with natural gas. Also, Union Pacific’s west coast port access affords it significant business in shipping imports from Asia (an advantage non-west-coast railroad companies don’t have). Additionally, the sheer large size of Union Pacific affords in competitive advantages via economies of scale.

From a financial standpoint, Union Pacific enjoys the advantages of a strong credit rating (investment grade). It also has lots of free cash flow that has enabled it buy back lots of its own shares and continue to pay attractive dividends to shareholders. Further, rail is still significantly cheaper than trucking, and this too affords UNP a competitive advantage.

What is UNP Worth?

We value UNP at $136 per share (using a discounted cash flows model), and we believe it has the ability to expand far beyond that amount in the decades ahead (because of its wide sustainable economic moat). Specifically, we discount UNP’s 2015 free cash flow of $2.9 billion (cash from operations minus capex) by its weighted average cost of capital (WACC) of 6.51%, and assume a 4% annual growth rate to arrive at a total value of $114.3 billion which we divide by 841.03 million shares to finally arrive at the share price. We have comfort in the 4% growth rate as UNP has managed to maintain growth in cash flow from operation during the slowing industry over the last 18 months, and they’ve also reduced operating costs (improve efficiency during this same period). And when the market cycle continues to improve, UNP will be more profitable that in the past (because of the higher efficiency). Additionally we believe UNP will continue to grow as the overall economy grows for many decades to come.

What are the Risks?

UNP’s profitability is largely dependent on growth in the economy. UNP would suffer if the economy were to slow, or if the market cycle were to turn negative. Another risk is regulation. Regulations could increase costs as well has govern/constrain prices UNP is able to charge for its services. UNP’s unionized workforce also poses a potential risk. collective bargain can increase labor costs and increase the likelihood of work stoppages. Also, more pressure on coal prices could also further hamstring UNP’s business (although they do have some ability to replace lost business in one segment with additional business in another).

Conclusion:

Union Pacific is a powerful cash generator, with a wide economic moat, an attractive dividend and the potential for very significant long-term price appreciation. We also believe Union Pacific is a “case study” on the importance of long-term “buy and hold” strategies. Specifically, Union Pacific’s price is lower than it was a year ago as its business has faced a lower point in its market cycle. Many fearful investors mistakenly sold low and have now missed out on the 32% rally off the lows so far this year (plus, they endured transaction costs (selling costs) and may also have missed out on other profitable opportunities by letting their money sit in cash instead of reinvesting it somewhere else). We continue to believe in the powerful long-term price appreciation of Union Pacific, and we also like its very attractive steady dividend payments.