Teekay Offshore Partners, LP is a leading provider of storage, production and transportation assets to the off-shore oil & gas industry. It’s preferred shares (TOO.B) offer an appealing dividend yield and stable cash flows, however uncertainties around future capital structure are worth considering. In this article, we analyze its business model, balance sheet, dividend potential as well as key risks and finally conclude with our opinion on whether the company’s preferreds offer an attractive balance between risks and rewards.

A Note to Members: We continue to own TOO.B shares in our Alternative Fixed Income portfolio, however we’d like to take this opportunity to remind readers that this is one of our riskier holdings. If you are looking for the safest yield, you might consider other preferred stock opportunities.

In the best case scenario, the company provides clarity on its future capital structure, and TOO.B keeps paying its big dividend, and the share price rises to near $25 (or higher).

In a less desirable scenario, Brookfield takes the company private, stops paying the dividend for an extended period of time, stops issuing financials for an extended period of time (because private companies don’t have to), this results in the share price falling further, but the company does eventually pay all dividends (in arrears—because they’re cumulative) and the share price returns to $25 (or higher) after an extended period of time.

In the worst case scenario, Brookfield takes the company through unnecessary bankruptcy proceedings, the dividend is halted, and shareholders get only a fraction of the $25 face value as the shares are essentially terminated.

We continue to own these shares, but are monitoring them closely.

Overview:

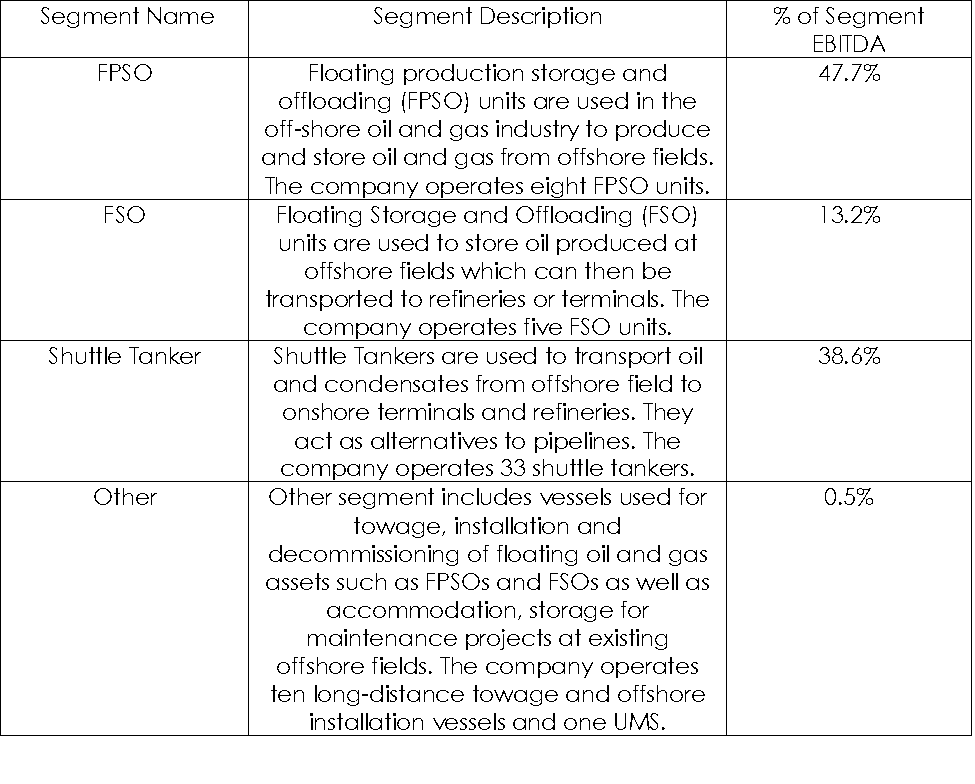

Teekay Offshore Partners, LP is a provider of midstream services to offshore oil and gas operators in North Sea, Brazil and the East Coast of Canada.

Longer term contracts with fixed fee based cash flows

The company’s contracts with its customers are long-term oriented with a fixed rate and therefore its cash flows during the period of a contract does not move with commodity prices. As such, the company’s cash flows do no exhibit the kind of volatility that typical oil and gas companies experience.

Company’s roster of preferred stock instruments

The company has three sets of preferred stocks currently outstanding. All are perpetural however series A preferred stock becomes callable in nearly a month and therefore yielding the least relative to other perferreds as some investors hope for the company to call the stock at its face value of $25. Series D is yielding the highest as of now but has a fixed coupon only until its call date and then moves to a LIBOR linked floating rate. Series B offers 12.6% yield while its call date is still seven months away. Please note that the company doesn’t necessarily have to redeem preferred stocks after the call date. It may choose to put in place a tender offer at a price below the par value of $25 instead.

Source: Quantum Online

Brookfield Transaction

The company has undergone a major transformation over the last few years that has significantly altered its risk profile. In 2017, Brookfield Business Partners, part of the Brookfield Asset Management group with over $385 billion assets under management acquired controlling interest in Teekay Offshore Partners, LP and since then has completely bought out Teekay Corporation’s GP and LP interest in Teekay Offshore Partners. As part of the deal, Brookfield invested $640 million in the form of equity and later $500 million in the company’s debt. The cash infusion helped the company avoid repercussions of having to refinance just under $1 billion in maturing debt in 2019 alone.

Dividend Safety

Preferred dividends hold a senior position relative to dividends paid to common stock holders. The company’s distributable cash flows have consistently been between 3-4 times its preferred dividend payment as evident in the chart below and therefore there is significant earnings cushion should the business deteriorate. Additionally, Teekay Offshore’s preferreds are cumulative and therefore any unpaid dividends accrue and become a liability for the company.

Source: Teekay Offshore Partners, LP

Note: Q4 2018’s DCF is estimated as the company stopped reported DCF as part of its quarterly disclosures.

Risks

Brookfield has recently announced its intention to buy all the common stock of TOO from the public. If this transaction goes through, the company’s stock will get delisted and the company may discontinue filing financials with the SEC and/or holding quarterly conference calls. If this takes place, it will lead to lack of information needed to track business progression for the preferred stock holders.

Additionally, the company may not stop at common stock and look to eliminate preferred stock from the capital structure as well. However, it may take the tender offer route at a lower rate instead of calling the preferreds at par given the deep discounts preferrerds trade at the moment. In fact, the company’s recent offer to buy all outstanding common stock of TOO was near the prevailing depressed market price at $1.05 per share rather than a “fair” value that should have incorporated improvements in leverage and liquidity situation since 2017 when the stock traded around $2.5 per share. Unsurprisingly, a minority shareholder group led by a hedge fund has recently sent a letter to the board highlighting unfair valuation commenting “We encourage Brookfield Asset Management (BAM) CEO Bruce Flatt to reconsider this transaction as it would be incredibly harmful to the Brookfield reputation and brand."

Finally, it may choose to delist preferreds while not redeeming them which will significantly impact liquidity and as a result pricing of these preferreds. Not surprisingly, the company’s preferred stock (TOO.B) dropped 20% around the time the news came out confirming Brookfield’s interest in taking the company private. The comment below from the CEO of TOO on Q4 2018 earnings call provides us some comfort that the company will treat its preferred stock holders well but it is important to watch this space due to recent developments.

“We've moved away from several of the characteristics from the MLP model. And as you point out, we have reduced the distribution to common unitholders to zero. And I would like to take the opportunity to say that we are not looking at doing anything similar to the preferred. But we take down the distribution to common unitholder in order to strengthen the balance sheet, build liquidity, and improve flex – financial flexibility going forward. That’s it.”

- Ingvild Sæther, CEO Teekay Offshore Partners, LP

Conclusion:

Teekay Offshore Partners, LP has come a long way since the transaction with Brookfield. The new operators have extended debt maturities as well as reduced leverage in a bid to de-risk the balance sheet. However, given Brookfield’s recent attempt to take the company private, there are legitimate concerns around the future of the company’s preferred stock.