“Dogs of the Dow” is basically a high-dividend contrarian strategy, whereby an investor selects annually for investment the ten Dow Jones (DIA) stocks with the highest dividend yields. This article reviews one particular Dog that we consider particularly attractive right now because of overblown trade war fears, its low volatility, its big growing dividend, and because the market is vastly underestimating its improved business.

Dow Jones Stocks:

Procter & Gamble (PG), Yield: 3.4%

Overview:

Procter & Gamble produces branded consumer goods, such as Charmin toilet paper, Crest toothpaste, and Tide laundry detergent. P&G has 65 brands in total, down from significantly more a few years ago (more on this later). We believe owning shares of P&G to be particularly attractive right now for the following reasons.

Overblown Trade War Fears

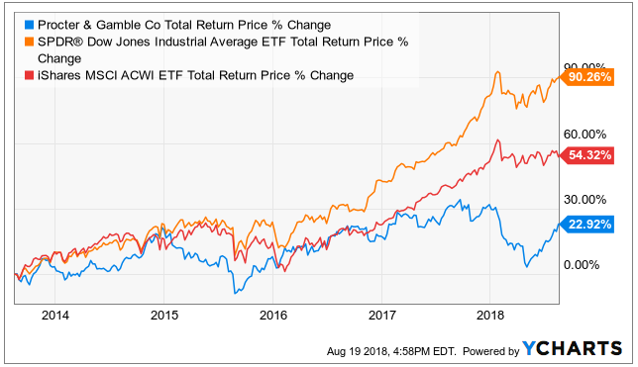

Here is a look at the recent performance of P&G versus the Dow Jones Industrials Average and the MSCI All Country World Index.

We included the MSCI All Country World Index because 60% of P&G’s revenues come from outside the US (30% emerging markets and 30% international developed markets). Part of the reason P&G has underperformed other Dow Jones stocks is because international markets have been challenged in light of the current US president’s trade wars and “America First” policies.

For a little more perspective on just how much emerging markets (mainly China, India, Brazil and Russia) have been underperforming, the following chart shows US stocks (SPY) are at a 14-year high relative to emerging markets (EEM).

In our view, the negative impacts of the current administration’s policies towards non-US businesses is overblown. There is a lot of fear baked into the valuations of non-US business right now. However, we suspect we could see a strong snapback in non-US business valuations when the “trade war” is eventually ended amicably, and P&G will benefit. Further, we believe the global economy is interconnected, and the benefits of “America First” policies will eventually benefit non-US economies too (a rising tide raises all ships). In a nutshell, we believe trade war fears are overblown, and this is one of the reasons P&G shares have upside.

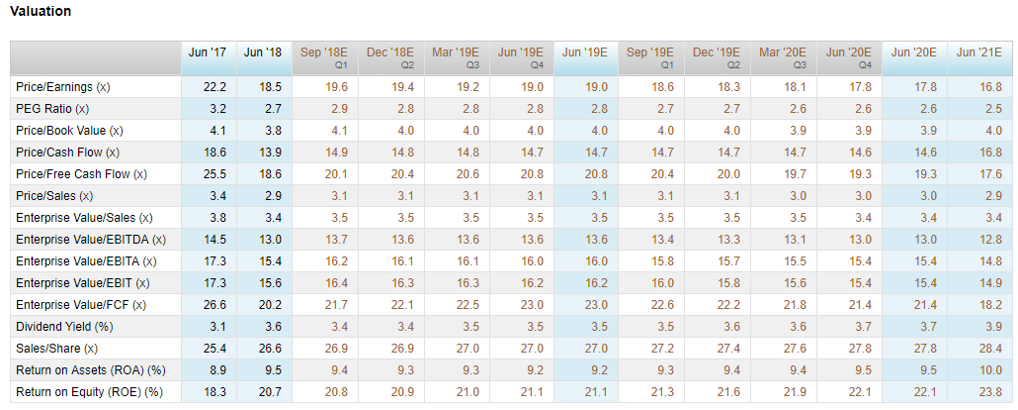

From a valuation standpoint, you can see that the 26 Wall Street analysts covering P&G believe EPS will rise, and the long-term growth rate will be 6.9%. We think it can be even higher, and we’ll provide more details on this later.

For reference, you can view additional estimates here…

And some P&G comps here…

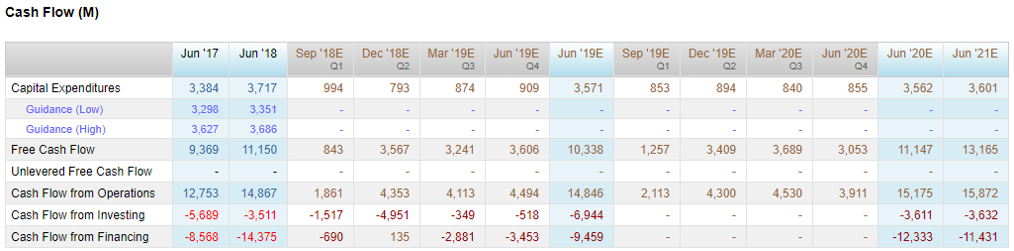

Also, free cash flow generation is expected to resume growth while capital expenditures remain controlled (management plans to cut certain costs while increasing marketing allocations).

Relative Safety (Market Frothiness Concerns)

Considering the market has been strong for an extended period of time now, many investors are getting concerned the market is “frothy” and due for a pullback. And while we’re not predicting a large market pullback anytime soon, we certainly can’t guarantee there won’t be one, and if there is: P&G is arguably much safer than the average stock because it has a lower beta (currently around only 0.6, whereas the average stock’s is 1.0), a heathy growing dividend (more on this later) and a stable steady business (for example, see its strong credit ratings below).

Further still, if you’re uncomfortable with the potential high volatility of the zero dividend momentum and growth stocks that have been power our multi-year bull market higher, then it can make good sense to diversify into some blue chip dividend growers like P&G. All investment styles go in and out of favor, and it can be wise to hold a stock like P&G considering it has a healthy growing dividend and price appreciation potential too.

Big Growing Dividend

Procter & Gamble’s dividend yield is currently one of the highest in the Dow Jones. P&G has also been increasing its dividend steadily for many years. Here is a look at the dividend increases and dividend yield over the last 10 years.

Also worth noticing, P&G has a strong history of returning cash to shareholders via share buybacks, as you can see evidenced in the shares outstanding count in the above chart. It is this steadiness that helps keep the company’s volatility relatively low. And it is the current capital appreciation potential that makes it particularly attractive to us right now. We also like that the dividend yield is currently near the higher end of the historical range (not the top, just higher) because we interpret this as a signal from management that they believe the share price should be higher, and when it gets there then the dividend yield will be more right-sized (i.e. management often sets the dividend based on where they expect the share price to be).

The Market Is Underestimating P&G’s Improved Business

P&G has completed a large multi-year restructuring within the last two years whereby they dramatically reduced the number of brands they own. Specifically, they got rid of the low and non-profitable brands (they’re down to only 65 now, as mentioned earlier). This makes them a “leaner and meaner” company going forward. According to Morningstar:

”Beyond reducing the complexity of its operations, P&G targets extracting another $10 billion of costs over the next few years by reducing overhead, lowering material costs from product design and formulation efficiencies, and increasing manufacturing and marketing productivity. We think these savings stand to fuel product innovation (including improved packaging) and advertising as well as increased sampling to prompt trial longer term, rather than merely providing a boost to profits. We forecast the firm will allocate 3% of sales for R&D and 11% of sales for marketing each year. Our long-term forecast calls for operating margins to improve to nearly 25% by fiscal 2028.”

We agree with how Morningstar is thing about this, but they are one of the few bullish P&G analysts on the street, as shown in the following graphic:

Most of Wall Street is only lukewarm (they’ve got a lot of “hold” ratings instead of “buys”), and we think they’re being too shortsighted (as usual), and a little blinded by the company’s recent past and overly cautious about trade war concerns. Here is a look at their EPS and segment forecasts:

As an example, the same Morningstar report notes:

“While much angst centers on P&G’s seeming lack of sales gains, particularly in its grooming arm, we see similarities to the challenges that previously plagued its beauty business. In the latter case, beauty had succumbed to intense competitive pressures from established branded operators and niche local players at a time when its innovation failed to align with consumer trends. However, management took prompt actions to course-correct, opting to part ways with unprofitable products and launching fare centered on its core anti-aging messaging. And we posit that P&G is also taking a sound strategic path to rebut the pressures in its grooming business resulting from lower-price upstarts--by recalibrating its pricing, investing in on-trend new products, and launching its own subscription-based sales model.”

Conclusion:

If you’re swinging for the fences, P&G is NOT for you. If you’re looking for a healthy dividend-growth contrarian opportunity to add risk-reducing diversity to your portfolio, P&G is worth considering. Not only is the dividend nice, but it has long-term inflation-fighting qualities (i.e. the share price will likely increase overtime), and we believe they’re particularly inexpensive right now for long-term investors because trade war fears have induced an indiscriminate non-US market sell-off. Plus if and when the FANG stock rally does eventually break (all investment types eventually go in and out of style), steady consumer staples stocks (P&G shares in particular) will likely experience a healthy increase in demand.