We've mentioned the attractiveness of this big-dividend payer in the past. And the shares are particularly inexpensive now. If you like value stocks and big dividends, you might want to consider purchasing shares.

Macerich (MAC), Yield: 5.3%

Macerich is a big-dividend retail REIT. It's attractive in it's own right for its healthy business, low valuation and attractive dividend. However, rather than purchasing the shares outright, this article details an alternative income-generating strategy for "playing" Macerich. Specifically, if you're not ready to purchase shares of this big-dividend REIT outright, then consider selling out-of-the-money put options--this way you'll get paid some attractive premium income upfront, and you'll also have a chance of owning the shares at an even lower price. Here is the trade idea...

The Trade:

Sell Put Options on retail REIT, Macerich (MAC), with a strike price of $52.50 (6.8% out of the money), and expiration date of May 18, 2018, and for a premium of $0.80 (this comes out to approximately 18.3% of extra income on an annualized basis, ($0.80/$52.50 x 12 months). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of big-dividend (5.3%) REIT, Macerich, at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own Macerich, especially if it falls to a purchase price of $52.50 per share).

Your Opportunity:

We believe this is an attractive trade to place today and potentially tomorrow as long as the price of Macerich doesn't move dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 15%, or greater.

Our Thesis:

Macerich is a baby that's been thrown out with the bathwater. Not only are investors afraid of the two big negative retail REIT narratives (rising interest rates and the disruption caused by online retailers), but fear is higher because the CEO is retiring and activist investors are challenging for board spots, as described in the following articles:

- M&A hope at Macerich after CEO's retirement

- Reuters: Macerich faces activist board challenge; shares up 4.4%

Fear and uncertainty create volatility, and volatility drives up the premium income available in the options market.

We like to sell income-generating put options, on stocks we'd like to own for the long-term, in particular right after a noisy sell-off. And MAC has not only sold-off with the entire REIT sector, but it's also sold off after its recent price gain following the announcement of the activist board challenge at the beginning of April has faded in recent days. This is an attractive window under which to sell these income generating puts.

More about Macerich:

Very importantly, we like Macerich over the long-term. For starters, it has forecast healthy 2018 FFO strength...

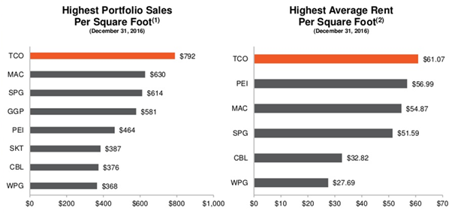

It also trades at a very inexpensive forward price-to-FFO ratio of 14.2x. And this is very inexpensive considering Macerich's attractive locations, high sales per square foot, and high rent per square foot.

And for what it's worth, the street has a $63.38 price target, thereby suggesting Macerich is undervalued.

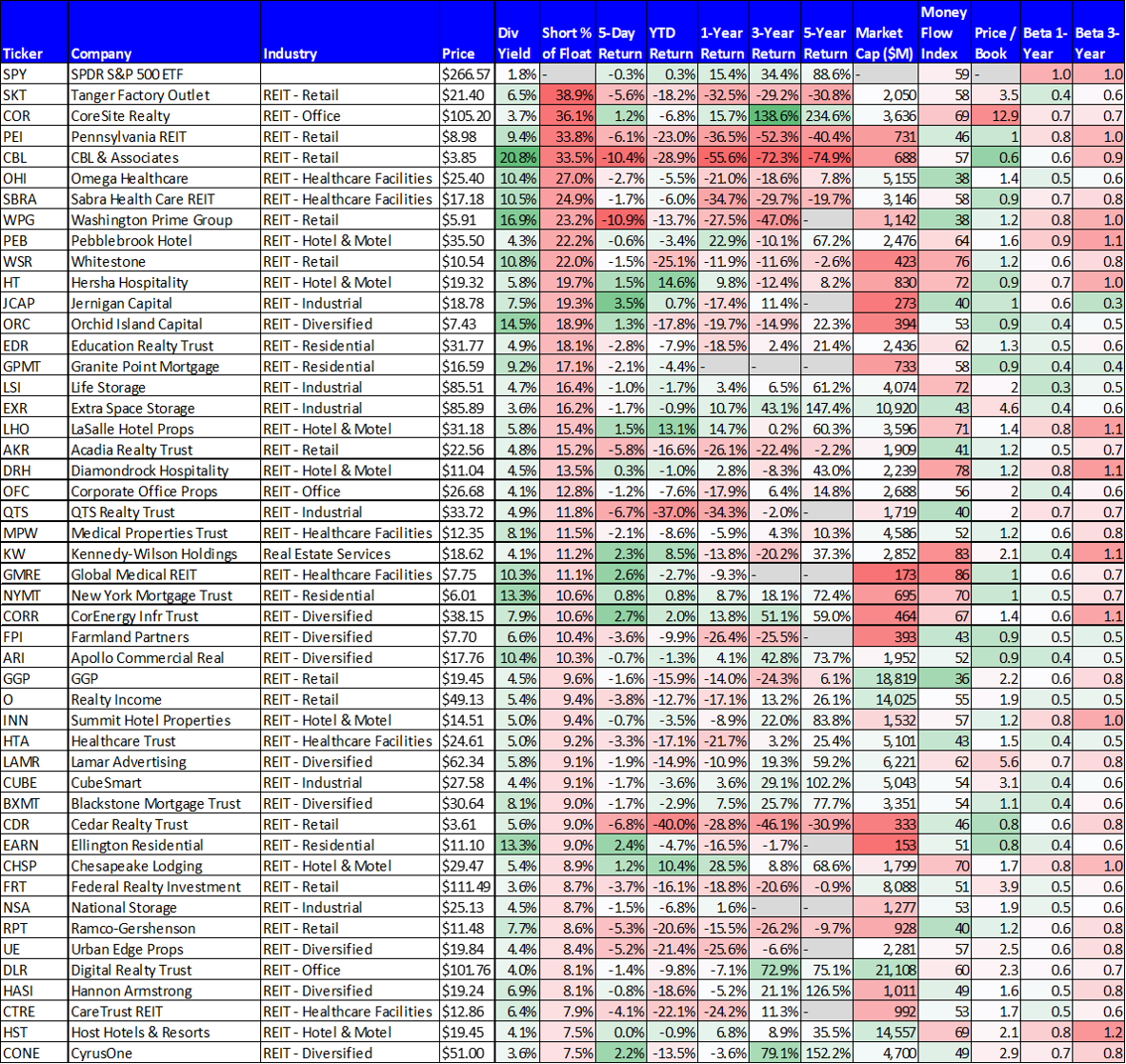

Also worth considering, Macerich is one of the least shorted REITs, as shown in the following table...

More on Macerich...

Macerich is a mid-cap retail REIT ($8.5 billion market cap). And before we get into the obvious retail REIT industry fears (mainly rising interest rates and growing internet competition) its worth mentioning that the non-large cap REITs may have an advantage over the large cap REITs, in our view. Specifically, as this sector struggles, we may see increasing consolidation (mergers and acquisitions), and we believe the large cap REITs will increasingly consider acquiring the smaller cap REITs, and when this happens—the large cap companies usually pay a premium and the small cap companies usually receive a premium. All else equal, smaller market caps would be more attractive (obviously all else is NOT equal, and we’ll get into that in a moment).

Regarding M&A activity, we believe it is a good sign for the industry overall because it suggests some smart, deep-pocketed, institutional investors believe the space is undervalued. For example, Unibail-Rodamco, Europe’s largest REIT, is buying Westfield (a mall owner in the US and the UK), and Brookfield Property Partners is trying to take over Chicago-based GGP (you can see GGP’s rent and sales per square foot, compared to SPG, in our earlier chart). As another example, European REIT Klepierre has recently pursued an acquisition of UK-based Hammerson. We believe there will likely be more M&A discussion throughout the industry, and the fact that these types of discussions are occurring is a good sign for mall REITs in general, in our view.

Another important differentiator for Macerich is that it is one of the higher quality retail mall REITs. Specifically, the location of its properties allows it to charge higher rent to its tenants, and the tenants are able to generate more sales per square foot, as shown in the following chart.

In our view, the less desirable real estate owners such as WPG and CBL (as shown in the above chart) will continue to face more challenges from store closures, tenant bankruptcies, undesirable rent concessions and growing internet competition. On the other hand, the highly trafficked, desirable location, experiential properties like Macerich will not only continue to exist, but they will thrive, and their shares are currently relatively inexpensive. We wrote more about retail REITs in general, and Macerich in particular, in this article from December:

One of the common responses from many investors when considering retail REITs is “don’t try to catch a falling knife.” We’re certainly not saying retail REITs have bottomed, but we are saying they are cheap from a valuation perspective as described in the above linked article.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. And in Macerich's case, they are both big deals. Specifically, Macerich will announce earnings in May before this options contract expires, and that adds uncertainty, volatility, and increases the premium income available on this trade. Also, Macerich will likely go ex-dividend right around the time this options contract expires. Depending on the upcoming ex-dividend announcement date, that adds volatility to this trade. However, given the long-term quality of Macerich, and the high premium income available on this trade, we are comfortable with these two additional important considerations.

Cash Secured or Leverage:

If you're going to sell put options on Macerich, you'll need to keep cash on hand in your account to cover the purchase price if the shares get put to you. Otherwise, your account needs to be approved for leverage (borrowing), and you'll use borrowed money to purchase the shares if the price falls far enough and they're put to you. Keeping cash is the more conservative approach.

Final Thoughts:

Macerich is a baby that's been thrown out with the bathwater. Despite this REIT's attractive strengths (e.g. FFO power, valuation, attractive properties) the negative narratives (interest rates, "death of retail," activist investor interest) has all created fear. And this fear is overblown in our view. And thereby it has created a very attractive opportunity to generate high income by selling put options.

If the shares get put to us before expiration--we're happy to own them at the much lower price. If the shares don't get put to us, then we're happy to simply keep the high income (premium) generated for selling the puts. And if you're not into the options trade, now is still an attractive time for long-term investors to consider simply initiating a new position in big-dividend (5.3% yield) Macerich (MAC)