This is a brief note to let our members know that we have initiated a new position in our Blue Harbinger Disciplined Growth portfolio. This is a name we mentioned in our “Members-Only Shopping List” over the weekend, and with the shares down again today, we’ve started a position. This is NOT a dividend stock, it’s a powerful growth company.

We sold half of our shares of healthcare juggernaut Johnson & Johnson (this position had grown large over the years) to initiate a position in Netflix. We continue to like J&J, and continue to own shares, however, we wanted to make room in the portfolio for Netflix, especially on its continued share pullback; Netflix shares will not remain down for long.

As we wrote over the weekend, we consider Netflix a perennial and growing powerhouse with a lot more room to grow. Netflix’s low subscription cost, ease of use, and enormous and growing content library make it a very compelling company. Further, its subscriber base can easy quadruple from here (the company currently has 135 million subscribers), and it can also easily raise its subscription price without causing subscribers to even blink (Netflix has “pricing power”). These attractive qualities give the shares a tremendous amount of upside from here, in our view.

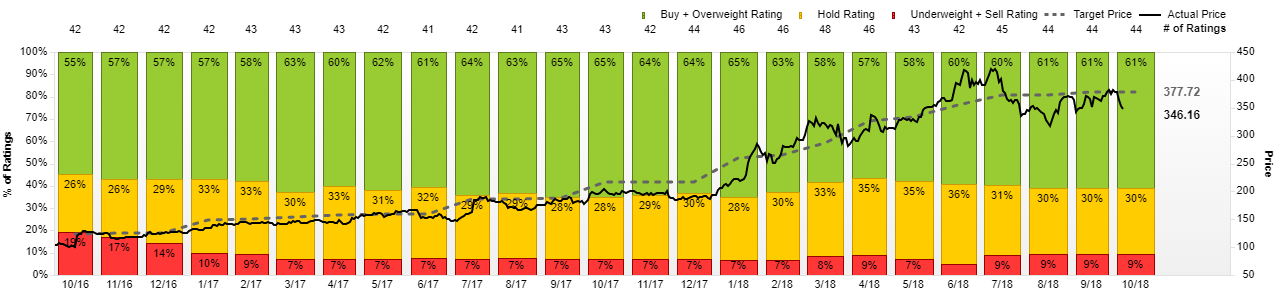

The shares continue to be liked by Wall Street (see price target and recommendation chart below), but Wall Street remains too short-term focused, in our view (the shares have significantly more upside than Wall Street’s short-term forecasts project).

We’ll have more to say about this trade soon, but we wanted to share this information with members right away.

You can view our latest monthly holdings update here.