Today we’re sharing an aggressive investment opportunity for your consideration. It’s the type of investment that generally only works when market volatility is high. However, despite the VIX being at historically low levels, there are still pockets of high volatility in the market where the premium is attractive for selling insurance (puts) on stocks we’d like to own anyway. We’ll happily take the cash for selling the puts now, and if the stock gets put to us in the future, it’s a stock we want to own anyway (and we will have gotten it at a much lower market price).

The Opportunity:

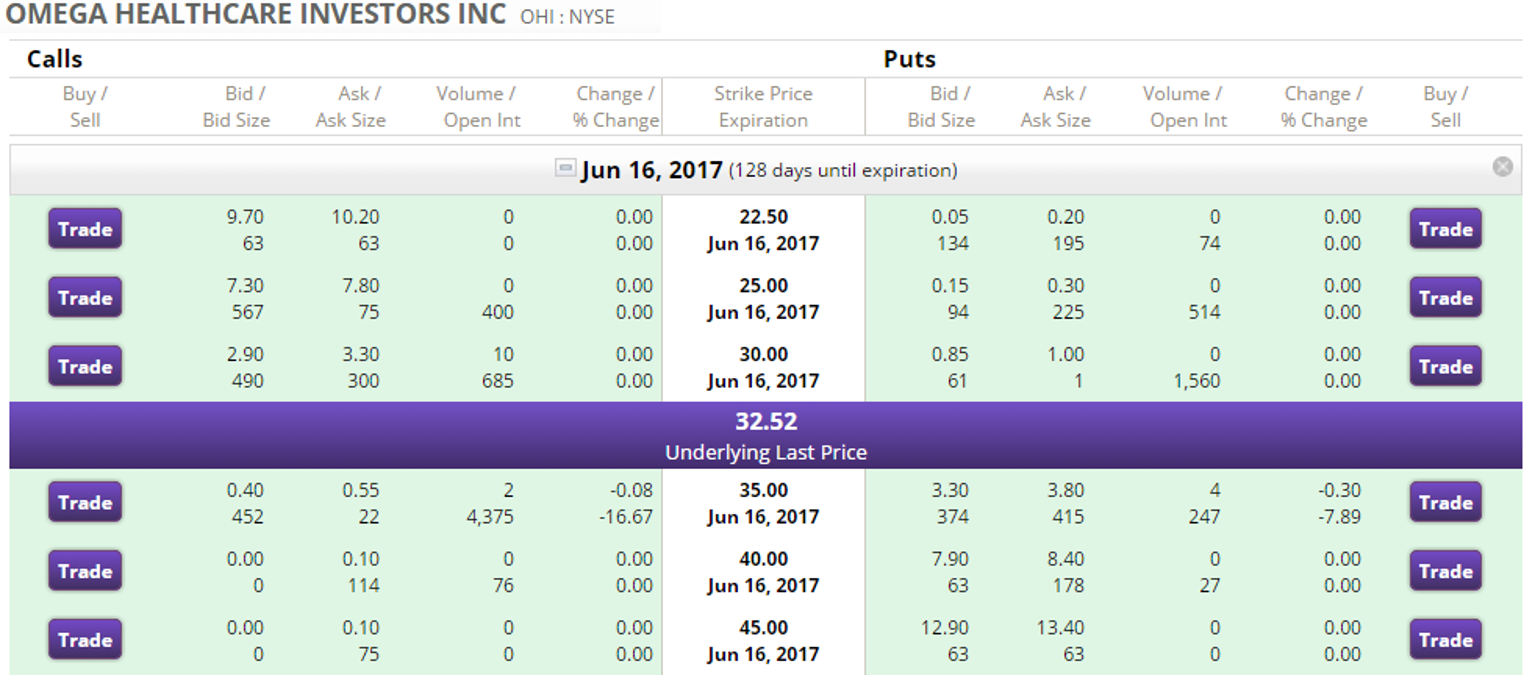

The aggressive investment idea is to take advantage of the high premium payments that are available for investors willing to sell insurance on healthcare REITs such as Omega Healthcare Investors (OHI). Specifically, by selling put options on OHI you will receive a healthy amount of cash now (the put premium), and IF the stock ever gets put to you, then you will end up owning a stock that we consider highly attractive, and you will have gotten it at a much lower market price (i.e. buy low).

For reference, Omega Healthcare Investors (OHI) is a healthcare REIT that we own in our Blue Harbinger Income Equity portfolio, and we’ve written about it multiple times in the past. For example...

Omega Healthcare: Big Dividend, Big Evolving Risks (23-Oct-16)

Omega Healthcare: Big Dividend, 3 Big Risks (27-Nov-16)

Top 3 Big-Dividend REITS Worth Considering (26-Jun-16)

Our basic thesis on the stock is that the price is too low because the market is overly fearful about potential changes to the Affordable Care Act. In fact, this fear has been particularly acute with regards to skilled nursing facility REITs like Omega. For reference, the following tables show the short interest and put option premium for Omega relative to other healthcare REITs and the S&P 500 (SPY)…

The point is that even though the VIX is near historical lows, there are pockets of attractive volatility for put writing (e.g. healthcare REITs). For reference, here is the historical VIX showing there is NOT a lot of volatility in the overall market (even though there is a lot in certain pockets of the market like healthcare REITs).

The Risks:

There are several risks worth considering when implementing this stategy. First you have to have the cash to purchase the shares of Omega IF they get put to you. You can accomplish this by keeping enough cash in your brokerage account to buy them, or by using margin. If you brokerage account is approved for margin then you can buy the shares (IF they’re put to you) on margin. Margin (borrowing) is a risk because even though it can magnify your returns, it can also increase your losses.

Another risk is that if the price of Omega falls dramatically lower, it can feel like you are overpaying if the shares get put to you. However, you’d still be getting the shares at a much lower price than today, and you have also already received the healthy premium.

Concentration risk is another risk worth considering. For example, we generally like to run this strategy with a basket of stocks (i.e. diversification). And we don’t recommend doing it on a bunch of stocks in the same industry.

For your consideration, the following table shows the recent short interest for the stocks in the S&P 500 with short interest greater than 5%. This can be a good place to look for other stocks that may offer healthy options premiums (i.e. high short interest usually means there is a lot of uncertainty and potential volatility with a stock, and these are the stocks that offer much higher options premiums).

If you’re going to attempt this put selling strategy, consider implementing it on stocks you’d like to own anyway. In our case we already do own OHI, and it’s a relatively smaller allocation within our portfolio so we wouldn’t mind owning more.

Conclusion:

Keep in mind, this is simply an investment idea, and we are NOT implementing it in any of our Blue Harbinger strategies, mainly because it’s a higher risk strategy (albeit with higher reward potential). Generally speaking, this is the type of trade that might be considered within the Left Brain Capital Appreciation Fund. Please feel free to send us a message with questions or comments.