Emerson Electric (EMR) is a big dividend (3.6%) industrial engineering company that is currently trading at an attractive price. The stock has recently under-performed the market for a variety of reasons, but it continues to easily maintain its “dividend aristocrat” status (i.e. it has raised its dividend every year for more than 25 years in a row). We believe Emerson has significant growth prospects ahead, and current market conditions have created a very attractive buying opportunity for long-term investors.

About:

Emerson Electric offers technology and engineering solutions for customers in industrial, commercial, and consumer markets around the world. The company operates through five business segments:

- Process Management: provides measurement, control and diagnostic capabilities for automated industrial processes.

- Industrial Automation: provides integrated manufacturing solutions to its customers at the source of manufacturing their own products.

- Network Power: designs, manufactures, installs and maintains products providing grid-to-chip electric power conditioning.

- Climate Technologies: provides products and services for the climate control industry.

- Commercial & Residential Solutions: offers a range of tools, storage products and appliance solutions.

An Attractive Business:

We like Emerson for a variety of reasons. For starters, it has built a strong brand name and reputation for itself across a variety of industries since its founding by John Wesley Emerson in 1890. It is headquartered in Missouri (the state it was founded in) but it has grown to operate in 150 countries. Additionally, Emerson is committed and experienced in emerging market economies which gives it significant room for future growth.

Another reason we like Emerson is because its dividend is safe. Specifically, it has generated nearly $2 billion to $3 billion in free cash flow in each of the last four years, but only pays out around $1.3 billion in dividends and has also been using some of its excess cash to buy back shares. It’s a “dividend aristocrat” (it’s increased its dividend for more than 25 consecutive years) and based on its low free cash flow payout ratio we believe it will easily maintain this status going forward.

Yet another reason we like Emerson Electric is because it’s profitable. Even though it’s faced challenges as the global economy has slowed in recent years, it consistently delivers profits as shown in the following chart.

Further, Emerson’s return on invested capital greatly exceeds its cost of capital. According to GuruFocus, those metric are 18.73% and 8.36%, respectively. Most companies are not able to achieve a spread this attractive (for many companies the spread is negative- not good).

Recent Price Declines Make for an Attractive Entry Point:

Another reason we consider Emerson attractive is because its price has recently declined for a variety of temporary reasons. And as long-term value investors, we like big-dividend, low-priced, attractive businesses like Emerson.

The first reason Emerson’s stock price has declined is because of its exposure to the energy sector. In 2014 (oil prices started to fall precipitously in the second half of 2014) roughly one third of Emerson’s sales originated in the energy sector. Since that time, Emerson continues to address the decline by re-optimizing its business to focus on high profitability segments and to reduce exposure to less profitable ones. Specifically, Emerson has been shedding non-core businesses, and is focusing on growing its industrial automation business, along with process management, and commercial and residential heating and air conditioning businesses. For example, earlier this month, Emerson agreed to sell its network power unit to investment firm Platinum Equity in a deal valued at $4 billion. Emerson also said that Japan's Nidec Corp will buy its motors and electric power generation unit for $1.2 billion. All of these changes have created uncertainty for some investors, but in our view it has created an attractive buying opportunity for long-term investors. Emerson isn’t going bankrupt, and its share price will rise considerably as its business adjusts and then grows.

Another temporary reason Emerson’s stock price is down is that just this week (Thursday) Emerson said it would buy pump manufacturer Pentair’s valves & controls business for $3.15 billion in cash. This is part of Emerson’s longer-term re-optimization of its business, but it creates short-term uncertainty for some investors which has contributed to its stock price decline (which creates a more attractive long-term buying opportunity in our view).

Another reason the stock price is down is because Emerson fell short of earnings expectations earlier this month. Specifically, it announced quarterly net sales of $5.1 billion (a decrease of 7%). According to Emerson, “The Company's third quarter results reflect the continuation of challenging demand conditions in our key served markets in addition to an environment of global economic uncertainty.” Again, we view this as a temporary part of the market cycle, and we also believe Emerson is making important changes to address longer-term opportunities. Said differently, we believe the earnings miss creates an attractive buying opportunity because the stock price is down temporarily, in our view.

Valuation:

On a discounted free cash flow basis, we believe Emerson is an attractive long-term investment. Specifically if we assume normalized long-term free cash flow of $2.5 billion (this is near the mid-point of the last four years), a weighted average cost of capital of 8.36%, a 3% long-term growth rate, and we adjust for outstanding debt, then Emerson is worth $39.4 billion, or approximately 16% more than it’s current stock price.

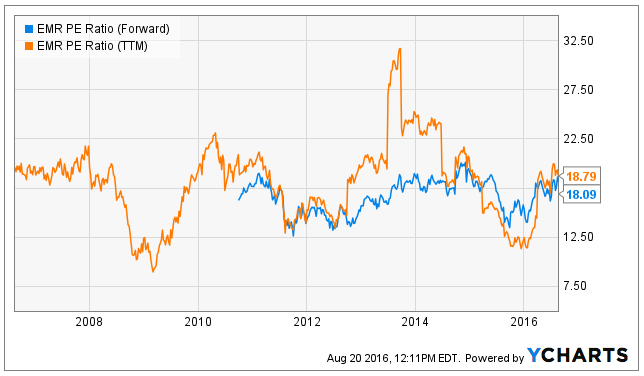

Additionally, Emerson is reasonably attractive from a historical price-to-earnings standpoint as shown in the following chart.

Risks:

Of course Emerson faces a variety of risks. For starters, its business re-optimization could take longer than anticipated, it could be more expensive than anticipated, and it could simply not work. We like that the company is taking steps to address changing market conditions (they’re shedding some business units and have recently acquired another), but there is no guarantee that their actions will be as fruitful as expected. Another risk is that Emerson is a higher beta stock. According to Google Finance it is 1.2. This means Emerson can be very sensitive to market moves and cycles. Additionally, Emerson’s operations in emerging markets can be volatile because those markets are volatile and because the currencies can be volatile. However, the big steady dividend helps make the volatility more bearable, in our view.

Conclusion:

Emerson Electric is an attractive business, with a nice dividend. Recent market events have caused the stock to under-perform, and it is currently trading at an attractive price. If you are a long-term income-focused investor, Emerson could be a very valuable addition to your diversified portfolio- not only because of the nice dividend, but also because we believe it has significant long-term price appreciation potential ahead.