This week's new investment idea is Autoliv (ALV). It was down 8.5% on Friday after announcing earnings that were slightly below expectations. However, the company is still very profitable, it has very significant growth potential ahead, and its shares are undervalued by the market in our view. Additionally, the company’s dividend yield just rose to 2.23% (because the price declined) which is above average compared to the S&P 500’s dividend yield of only 2.04%.

Autoliv is the world’s largest automotive safety supplier with sales to all the leading car manufacturers in the world. The company develops, manufactures and markets protective systems such as airbags, seatbelts, steering wheels, passive safety electronics and active safety systems including radar, night vision and camera vision systems.

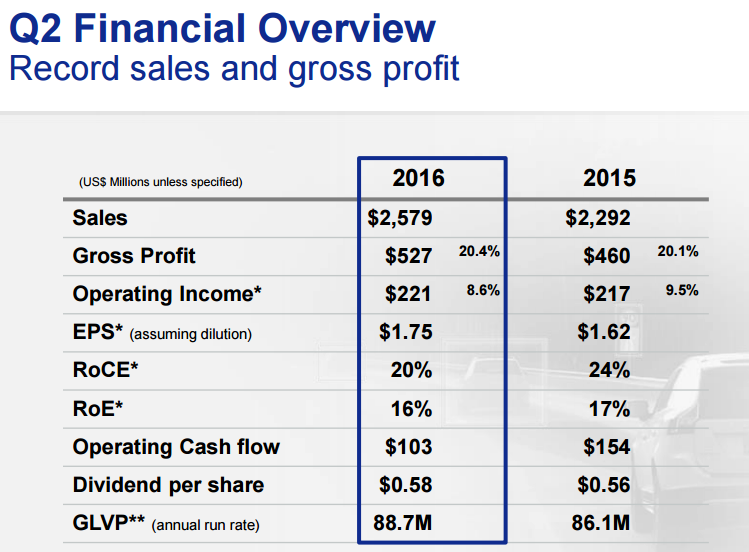

Despite Friday’s price decline, the company continues to be very profitable and maintains high margins. For example, during Friday’s conference call, Autoliv announced second quarter sales grew 12.5% versus the same quarter last year, and earnings per share grew to $1.72 from $1.62 in Q2 2015.

Also important to note, the company’s weighted average cost of capital is only 8.47% according to the reasonable assumptions at GuruFocus, and their return on capital is 16.03%. This is a very significant margin, and it means for each new dollar the company invests, they generate a very healthy profit (this is not true of many other company that actually have a cost of capital higher than their return on capital).

Prior to the earnings announcement, Autoliv expected organic sales would grow 10%. However, organic sales only grew by 7.7%. The lower number was driven by lower seatbelt product sales in North America and South Korea. However, the company still grew organically, and it also grew inorganically through acquisitions (Autoliv purchased MACOM Technology Solutions automotive business last year).

Future Growth:

During Friday’s conference call, Autoliv provided guidance for continued growth. For example, the company expects full-year 2016 sales to increase 7%, and for operating margin to remain healthy at greater than 8.5%.

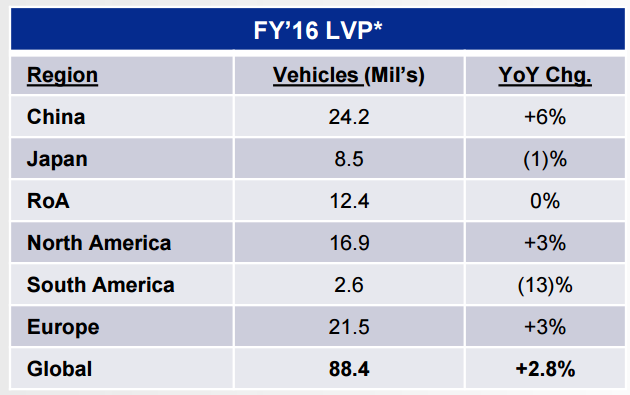

For added perspective, the following chart shows overall macroeconomic conditions are expected to improve to 88.4 million Light Vehicle Production (LVP), an increase of 2.8% from the previous year.

However, Autoliv continues to experience a higher level of growth. For example, the following table shows growth across Autoliv units.

Interesting to note, “Active Safety Sensors” have grown 73%. This is an example of Autoliv’s ability to innovate new products. As a testament to Autoliv’s history of innovation, they were the first to introduce the two- and three-point seat belt system and airbags for front and side impacts. Autoliv was also the first to launch pyrotechnic belt pretensioners and pedestrian protection systems.

Another interesting competitive advantage is that much of Autoliv’s workforce is located in the emerging markets where significant products are sold, and the costs of labor are much lower in these areas. These lower labor costs are a contributing factor to Autoliv’s ability to maintain strong margins.

Valuation:

We believe Autoliv shares are likely to increase at a faster rate than the overall market. We use a basic discounted free cash flow model to value Autoliv, suggesting the stock may be undervalued by about 12%. For starters, this table shows the company’s historical free cash flows.

We discount the last twelve months (LTM) free cash flow (+$383 million) by a weighted average cost of capital of 8.47% (as mentioned earlier) and assume the company grows at 7% for the next 5 years, before reverting to a long-term growth rate of 4%. After adjusting for long-term debt, we arrive at an equity value of $10.5 billion. This suggests the shares are more than 12% undervalued now. Of course this valuations is based on a variety of assumptions, and the actual valuation could be higher or lower. However, we believe the shares are likely to climb higher over the long-term at a faster pace than the overall market.

Additionally, Autoliv’s dividend is nice. As the following chart shows, the dividend has been increasing since being cut during the financial crisis.

Additionally, the company has board approval to repurchase shares in the future. Such share repurchase could be accretive to shareholders, and increase the stock price, if management decides it is prudent to repurchase the shares.

Risks:

Autoliv faces a variety of risk exposures, and we've highlighted some of the more significant ones as follows. For starters, competition is always a risk. According to the company’s annual report: “Pricing pressure from customers is an inherent part of the automotive components business. The extent of price reductions varies from year to year, and takes the form of reductions in direct sales prices as well as discounted reimbursements for engineering work.”

The market cycle is another risk. For example, since nearly 30% of Autoliv’s costs are relatively fixed, short-term earnings are highly dependent on capacity utilization in the Company’s plants and are, therefore, sales dependent. If sales fall due to macroeconomic and/or cyclical conditions, this could negatively impact Autoliv’s price.

Materials costs are another risk that could have a major impact on margins. For example, the cost of direct materials is approximately 54.3% of sales. If materials costs were to rise dramatically, this could have a significant negative impact on the company and the share price.

Foreign currency exchange rates also pose a risk. As the company notes in its annual report: “Transaction exposure arises because the cost of a product originates in one currency and the product is sold in another currency. Revaluation effects come from valuation of assets denominated in other currencies than the reporting currency of each unit.”

Conclusion:

Autoliv is an attractive company because of its profitability, its expected future growth, its dividend, and its current valuation. Friday’s stock price decline (-8.5%) provides an additional margin of safety for long-term investors. The decline was driven mainly by lower organic growth than expected, but the company continues to grow, and we believe it is likely to deliver future returns at a higher rate than the overall market.