Ventas (VTR) is a healthcare REIT with a diversified investment portfolio, an attractive dividend yield (4.1%), and the winds of an enormous demographic trend at its back. The dividend is very safe, and despite the recent strong price performance we believe this REIT has many years of continued growth ahead.

Overview

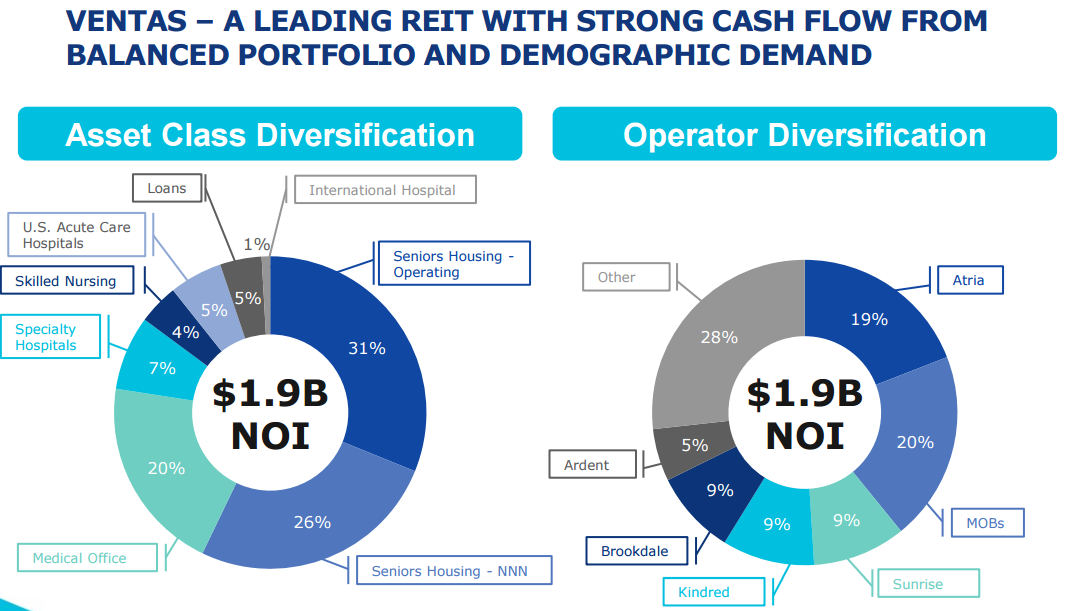

For starters, the following chart shows the Ventas portfolio’s diversification across healthcare asset classes and operators.

This diversification is important because it reduces the operational risks that exist for less diversified healthcare REITs. For example, Ventas’ peer HCP is currently struggling with its largest concentrated tenant, HCR ManorCare, and that’s caused HCP’s price to underperform.

The Opportunity

This next series of graphics provides color on the demographic winds at Ventas’ back, mainly the growing aging population and the growing need and use of healthcare. For example, healthcare spending is projected to grow at 5.8% annual through 2024.

Interestingly, this next chart shows the percent of industry real estate ownership for REITS.

And as the chart shows, healthcare REITs own a relatively small percentage relative to REITs in other industries which helps quantify another aspect of the growth that lies ahead for healthcare REITs such as Ventas.

Valuation

Just because Ventas has significant growth opportunities ahead doesn’t necessarily mean it’s an attractive investment, and some quantification of its valuation is prudent. For starters, this next chart shows Ventas’ Funds from Operations (FFO) growth versus peers since 2001. (FFO is a primary measure of profitability and ability to support and grow the dividend for REITs. It’s calculated as net income adjusted for depreciation/amortization and gains/losses on real estate sales).

As the chart shows, the growth has been impressive. And management has provided guidance for continued growth in 2016 and beyond. For example, the Ventas expects FFO of $4.07 to $4.15 for 2016 representing growth of 3-5%. This is lower than historically, but it represents continued growth nonetheless.

This next chart shows Ventas versus its peers on various metrics including Dividend to FFO and Price to FFO as of July 14, 2016.

As the chart shows, Ventas has performed well recently in terms of total returns (price appreciation plus dividend payments). However, it still offers a relatively attractive dividend yield, and its dividend to FFO ratio is low compared to peers. This is a good thing because it suggests Ventas dividend is not at risk of being cut, and the company has the financial wherewithal to continue increasing it in the future. However, Ventas looks expensive compared to peers as it has a higher price to FFO ratio. However, given the tremendous demographic growth ahead, as well as Ventas’ ability to continue to increase the dividend payout, this Price to FFO ratio is not overly concerning, and Ventas should easily generate the long-term growth to back it up.

Risks

It’s worth considering some of the risks Ventas faces. For example, healthcare is a highly regulated industry. And future changes to the struggling affordable care act could adversely affect the company.

Another risk is the possibility of a pullback in the prices of REITs in general. As central bankers have kept interest rates artificially low, investors have flocked to REITs because of their big safe yields, and this has driven up the price of REITs. It would not be surprising to see REIT growth and performance slow in the near-term before resuming its long-term growth along with the long-term growth in the healthcare industry. Additionally, it seems unlikely that central banks will raise interest rates significantly any time soon given continued global economic challenges.

Another risk is property concentration. Even though Ventas is well-diversified relative to peers, their properties managed by Atria and Sunrise account for a significant portion of their revenues and operating income. Any problems with these two would create problems for Ventas.

Conclusion

We like Ventas. It’s an attractive healthcare REIT that will benefit from continued demographic growth, it has exhibited low volatility, and has consistently generated cash flows to support and grow its already attractive dividend yield. However, its price has rallied significantly with the rest of the REIT industry, and its valuation is on the higher end of its historical range at 18.6 times FFO. And even though we believe it will eventually generate more than enough growth to back up its current valuation, and we believe the dividend is very safe, we do not currently own shares. Ventas will remain on our watch list, and we may purchase shares in the future if there is a significant price pullback.