AstraZeneca (AZN) is a biopharmaceutical company with a big 4.7% dividend yield. The market is overly pessimistic and too shortsighted with regards to AstraZeneca’s future. Specifically, the market is focused on the company’s upcoming loss of patent protection on two of its top drugs (Nexium and Crestor) over the next two years. And the market is completing missing the company’s tremendous long-term pipeline prospects. If AstraZeneca comes even close to its 2023 revenue goal of $45 billion then now is an exceptional opportunity for long-term investors to consider buying into this big-yielding biopharma company.

About

AstraZeneca is based in London, but trades as an American Depository Receipt (ADR) on the New York Stock Exchange. It was formed in 1999 when Sweden-based Astra merged with UK-based Zeneca. It sells brand name prescription medicines for respiratory, inflammation, autoimmune disease (RIA), cardiovascular and metabolic disease (CVMD) and oncology, as well as in infection, neuroscience and gastrointestinal areas.

Upcoming Patent Losses

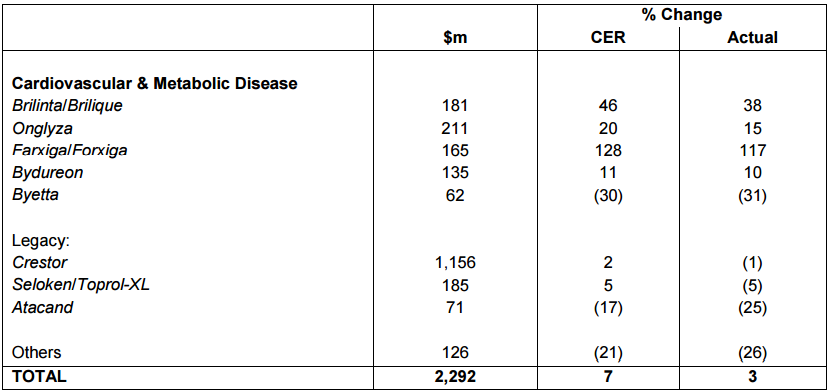

AstraZeneca will lose patent protection on two huge drugs in 2015 and 2016: Nexium (a gastrointestinal drug) and Crestor (a cholesterol reducer). As shown in the following table, Nexium makes up 8.3% of total revenue and Crestor makes up 20.8%. The market seems laser focused on these two losses (they are big losses as competition will creep in), but the company does have a significant pipeline to help them achieve their 2023 goal of $45 billion in total revenue.

Pipeline

AstraZeneca has significant pipeline growth potential as shown in the following table.

And several of these initiatives have the potential to become blockbuster medicines.

Additionally, here’s a breakdown of where the medicines are within the medicine lifecycle.

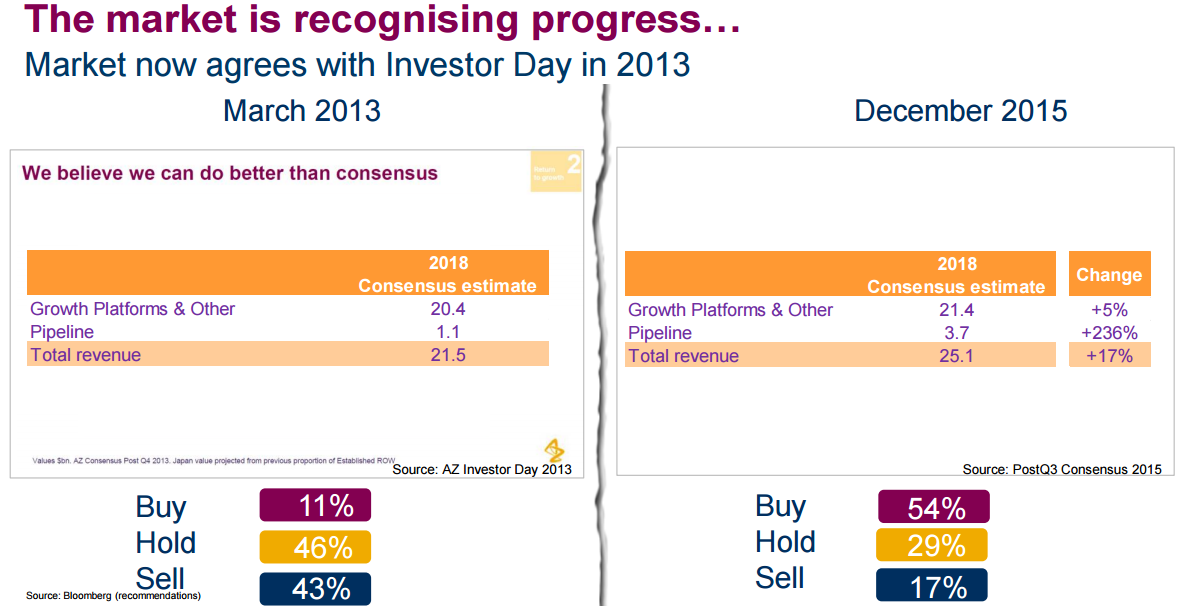

The Market has a History of Underestimating AstraZeneca

Also worth noting, the market has a history of underestimating AstraZeneca. As the following graphic show, the market is just now giving the company credit for things it provided guidance for back in 2013 (i.e. the market has been overly pessimistic, and too shortsighted).

Valuation

As a base case scenario, we assume AstraZeneca reaches its $45 billion 2023 revenue goal. We also conservatively assume that AstraZeneca will be able to achieve a 20% profit margin, which is not inconsistent with its historical profit margin as shown in the following the chart.

And using these estimates, and assuming AstraZeneca would trade at a 15x price-to-earnings multiple (which is not unreasonable given its history per the chart below), then the company would be worth approximately $135 billion giving its stock price approximately 82% upside.

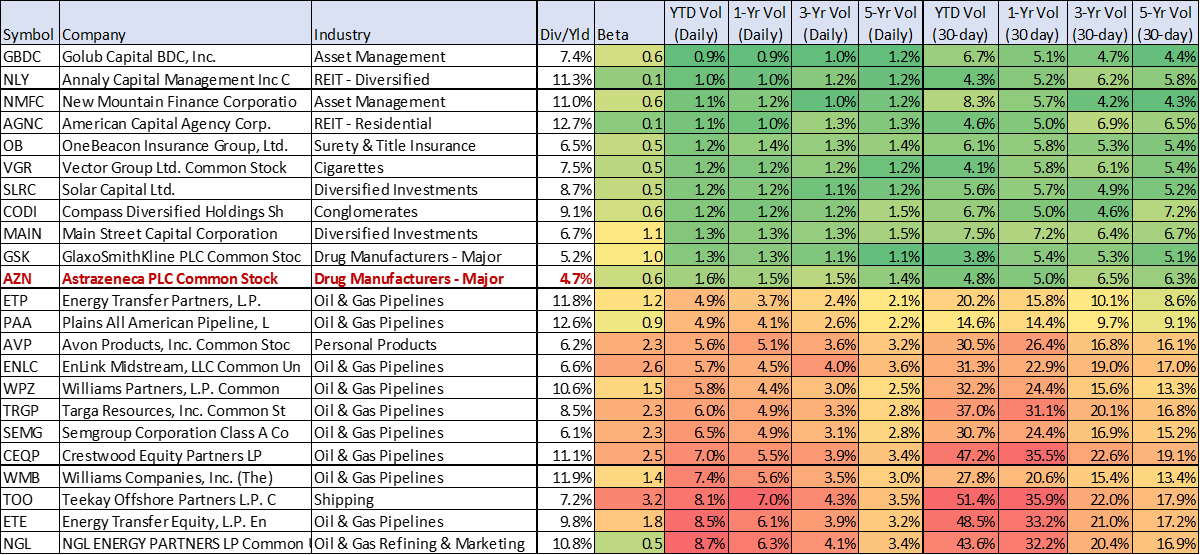

Also important for many investors, AstraZeneca has a low beta and relatively low volatility as shown in the following chart of high dividend stocks.

These are important characteristics for many income-focused investors because it can add diversification benefits and reduce risk within a diversified investment portfolio.

Risks

AstraZeneca also faces a variety of risk factors. For example, it may experience growing pains over the coming 1-2 years as old drugs lose patent protection and new drugs are still ramping up. This could cause increased volatility, and the stock price may go lower before it goes higher (we believe strongly it will go higher in the long-term). AstraZeneca also runs the risk that its new drugs are not as successful as hoped. Further, drug makers face high risks of lawsuits from customers and from competitors. Additionally, regulators can impose restrictions that restrict profitability. Additionally, the drug manufacturing industry is highly competitive which could reduce AstraZeneca’s profitability.

Conclusion

We are contrarians with regards to AstraZeneca. Whereas the market consensus is becoming increasingly negative (the stock is down 12.4% this year while the S&P 500 is up 2.7%), we believe the patent loss fears are overdone, and the market is not recognizing the dramatic long-term potential of the AstraZeneca pipeline. If you are a diversified long-term income-focused investor, AstraZeneca is worth considering.