The risks associated with this Greek shipping company are decreasing, but the shares don’t yet reflect its improving prospects. Depending on your preference for dividends versus price appreciation, both the common and preferred shares are worth considering. We’ve owned the common shares within our Blue Harbinger Income Equity strategy since early 2016, and we believe significant price appreciation lies ahead. Further, we believe the preferred shares continue to become less risky and the high-yield is very attractive.

Tsakos Energy Navigation Common (TNP) Yield: 4.34%

The company we are referring to is Tsakos Energy Navigation (TNP). If you don’t know, Tsakos is a provider of international seaborne crude oil and petroleum product transportation services (the company is based out of Greece). The shipping industry, in general, has been decimated in recent years as shown by the Shipping ETF versus the S&P 500 in the following chart.

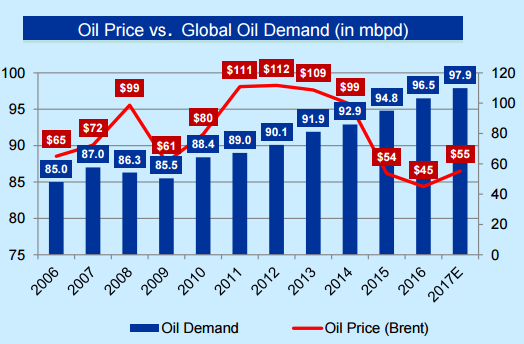

However, condition are improving for Tsakos as oil demand continues to perk up as shown in the following table.

According to the company, “oil barrels from Nigeria, Libya, Iran and the rejuvenation of the US shale industry is filling the void the OPEC (and non-OPEC) cuts have created in the markets. As a result, oil prices continue to remain at attractive levels to stimulate global demand and by extension seaborne tanker trade.”

For some perspective, the following graphic shows Tsakos’ fleet is comprised largely of crude tankers (and to a lesser extent products and then LNG).

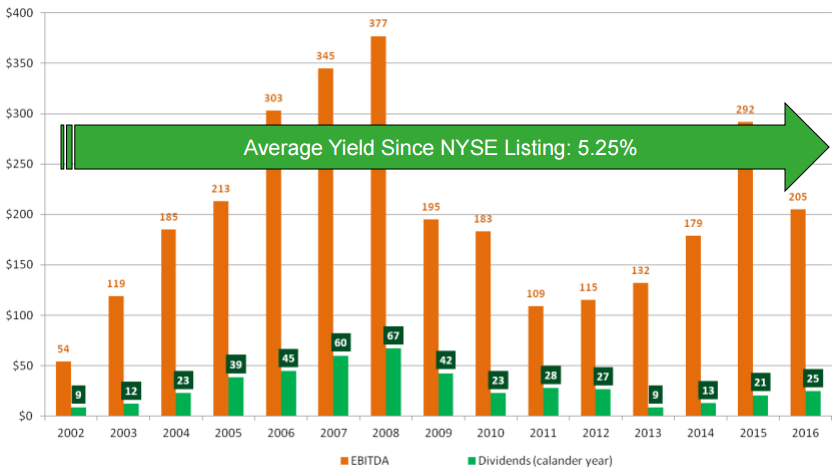

For additional perspective, this next chart shows that Tsakos Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) has been picking up, put its share price has not kept pace (i.e. the common stock share price is still cheap).

For more perspective, this next graph shows Tsakos’ dividend payments versus EBITDA.

Tsakos has a history of adjusting its dividend payments to meet the prevailing market conditions. However, despite recent EBITDA increases, the dividend payments remain relatively low versus history. Very important to note, Tsakos is one of the few shipping companies to maintain a dividend on its common shares during the challenging market conditions over the last few years. In contrast, many of Tsakos’ peers cut their dividends to zero, and a significant amount even filed for bankruptcy.

Worth noting, Tsakos' strength comes in large part from its strategic alliances with blue chip companies such as those shown in the following graphic.

Based on the improved and relatively healthy demand for crude oil (as well as growth in LNG, and improving economic conditions overall), we believe Tsakos’ dividend may be increased again in the near future (over the next year). Additionally, we believe the shares have significant price appreciation potential based on both multiple expansion (it deserves a higher price to EBITDA ratio), and based on improving market conditions and continued worldwide economic growth.

For reference, you can read our write-up on Tsakos from February 2016, here:

Tsakos Energy Navigation Preferred (TNP-E) Yield: 9.22%

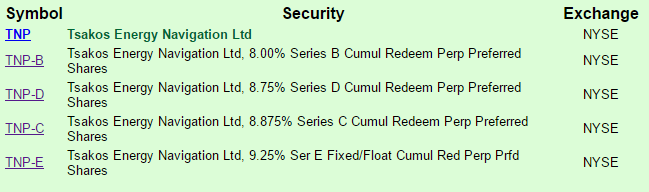

In addition to common shares, Tsakos currently has four series of preferred shares outstanding, as shown in the following graphic.

The Series E shares are our favorite because they are newly issued, they offer a higher yield, and they cannot be redeemed at the company’s discretion as soon as the other share classes can be. For example, Tsakos can redeem the:

• Series-B on or after 7/30/2018 at $25 per share

• Series-C on or after 10/30/2018 at $25 per share

• Series-D on or after 4/29/2020 at $25 per share

• Series-E on or after 5/28/2027 at $25 per share

Importantly, the Series-E dividend is a floating rate equal to three-month LIBOR plus a spread of 6.881% per annum. This is attractive because if interest rates continue to rise, then the dividend payments on these shares will also rise. The Series-E shares also trade very close to the $25 redemption price; specifically, the current price is $25.09 (i.e. they’re not trading at any big discount or premium).

Also important to note, in regard to the payment of dividends and upon liquidation, the preferred shares rank junior to the company's senior debt, equally with other preferreds of the company, and senior to the common shares of the company.

Conclusion:

We believe market conditions are improving for Tsakos. We also believe Tsakos’ financials are improving. However, its share price still does not reflect these improvements to the extent we believe it should. Said differently, we believe the common shares have the potential for significant price appreciation as well as a dividend increase. Further, we believe the Series-E preferred shares are particularly attractive for income-focused investors because they offer a big safe dividend (Tsakos would cut the dividend on the common shares just to support the preferred shares if need be, because they’re higher in the capital structure), and the preferred share price is far less volatile than the common.

Depending on your preference for low-volatility and high income (the preferred shares) versus your interest in some dividend income and potential for significant price appreciation (the common shares), an investment in Tsakos is worth considering.

As a reminder, we currently own shares of Tsakos common shares. And you can view all of our current holdings here.